SSS Contribution Table for OFWs (Land-Based) in 2025

The SSS Contribution Table for OFWs (Land-Based) is a document that outlines the monthly contributions that Overseas Filipino workers (OFWs) are required to pay to the Social Security System (SSS) in the Philippines. OFWs who are based in other countries and earn a foreign salary are required to pay the same contributions as any other member of the SSS.

OFWs are required to make monthly contributions to the SSS to be eligible for the benefits and services provided by the organization. These benefits include retirement, disability, and survivor’s pensions, as well as loans and other forms of financial assistance.

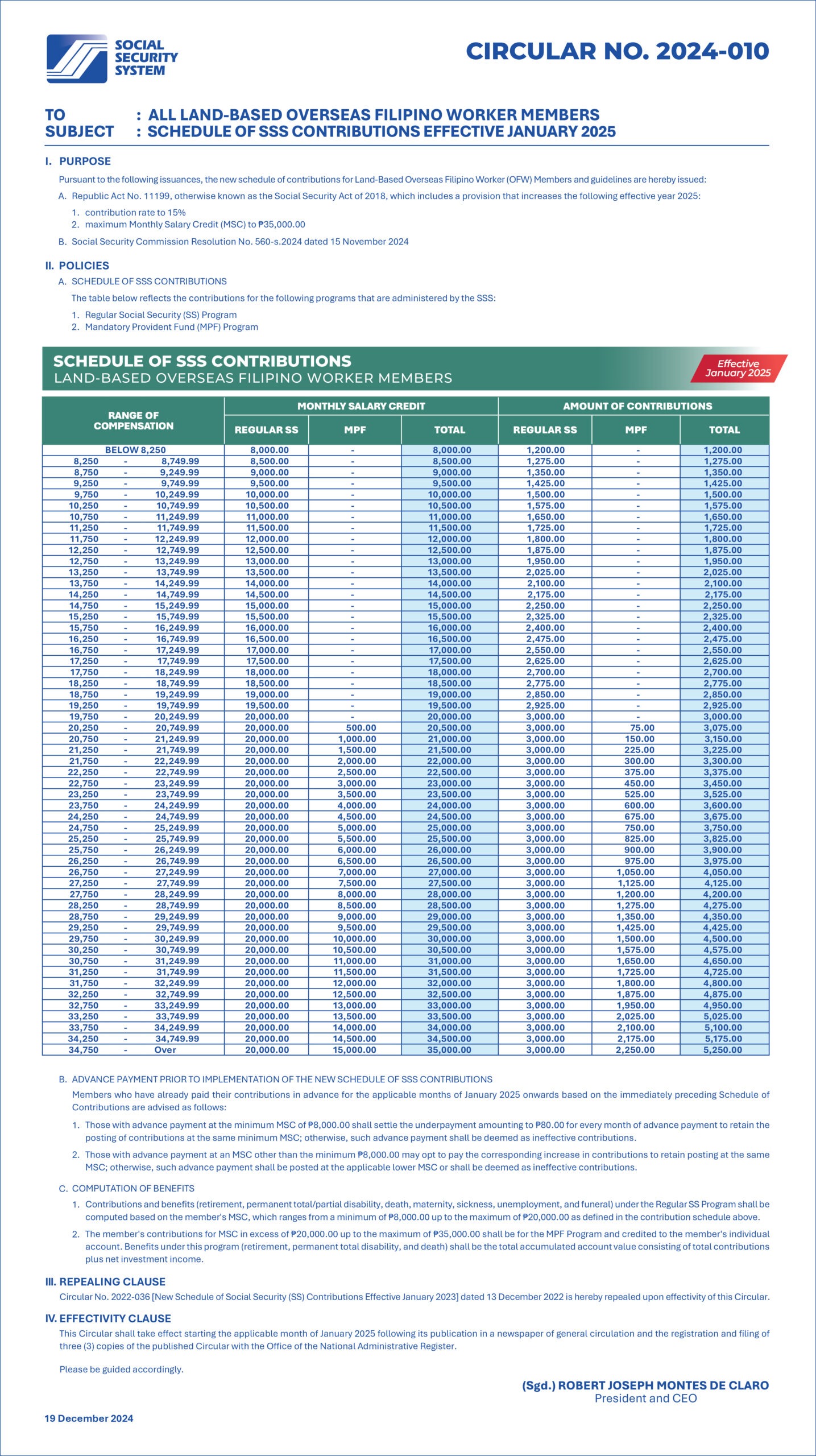

The SSS Contribution Table for OFWs (Land-Based) lists the minimum and maximum monthly salary credits, as well as the corresponding monthly contributions for each salary bracket. The table also includes the total monthly contributions for those who are paying for the optional SSS loan, maternity benefits, sickness benefits, and/or death and funeral benefits.

Must Check: List of SSS Branches Overseas

What are the SSS Contribution Rates for OFWs?

OFWs are divided into two categories: land-based and sea-based. The contribution rates for land-based OFWs are as follows:

- For those earning a monthly salary of PHP 10,000 or less, the contribution rate is 15% of the regular monthly salary credit. For example, your monthly salary credit is PHP 9,500, so in this case, your contribution amount would be PHP 1,425 (₱9,500 x 15%).

- For those earning a monthly salary of more than PHP 20,000, the contribution rate is 15% of the total monthly salary credit (Regular SS + Mandatory Provident Fund amount). For example, if your Regular Social Security is PHP 20,000 and your MPF is PHP 1,000, then your contribution amount would be PHP 3,150 (₱21,000 x 15%).

These rates are subject to change on a yearly basis. OFWs are advised to check our website regularly for the most up-to-date information on contribution rates.

How are SSS Contributions for OFWs (Land-Based) calculated?

The SSS uses a progressive contribution schedule, which means that the higher the salary, the higher the contribution. The monthly salary used to calculate the contribution is the total amount received by the member, including allowances and bonuses.

For OFWs, the range of compensation to compute the contribution is Below PHP 8,250 to PHP 34,750 and over. The amount of contribution ranges from PHP 1,200 to PHP 5,250 per month.

You can use the SSS Contribution Calculator for quick and precise results.

How to pay SSS contributions for OFWs?

OFWs can pay their SSS contributions at any SSS foreign representative office or accredited bank in the country where they are based. They can also pay through the SSS Electronic Payment System (EPS) or through authorized collecting agents.

It is important for OFWs to regularly pay their SSS contributions to ensure that they are eligible for the various benefits offered by the SSS, such as retirement, disability, and death benefits.

OFWs who are unable to pay their contributions on time can apply for a repayment program, which allows them to pay their overdue contributions in installments.

SSS Contribution Table for OFW’s (Land-Based) 2025

| Range of Compensation | Monthly Salary Credit | Amount of Contributions | ||||

|---|---|---|---|---|---|---|

| Regular SS | MPF | Total | Regular SS | MPF | Total | |

| Below 8,250 | ₱8,000 | – | ₱8,000 | ₱1,200 | – | ₱1,200 |

| 8,250 – 8,749.99 | ₱8,500 | – | ₱8,500 | ₱1,275 | – | ₱1,275 |

| 8,750 – 9,249.99 | ₱9,000 | – | ₱9,000 | ₱1,350 | – | ₱1,350 |

| 9,250 – 9,749.99 | ₱9,500 | – | ₱9,500 | ₱1,425 | – | ₱1,425 |

| 9,750 – 10,249.99 | ₱10,000 | – | ₱10,000 | ₱1,500 | – | ₱1,500 |

| 10,250 – 10,749.99 | ₱10,500 | – | ₱10,500 | ₱1,575 | – | ₱1,575 |

| 10,750 – 11,249.99 | ₱11,000 | – | ₱11,000 | ₱1,650 | – | ₱1,650 |

| 11,250 – 11,749.99 | ₱11,500 | – | ₱11,500 | ₱1,725 | – | ₱1,725 |

| 11,750 – 12,249.99 | ₱12,000 | – | ₱12,000 | ₱1,800 | – | ₱1,800 |

| 12,250 – 12,749.99 | ₱12,500 | – | ₱12,500 | ₱1,875 | – | ₱1,875 |

| 12,750 – 13,249.99 | ₱13,000 | – | ₱13,000 | ₱1,950 | – | ₱1,950 |

| 13,250 – 13,749.99 | ₱13,500 | – | ₱13,500 | ₱2,025 | – | ₱2,025 |

| 13,750 – 14,249.99 | ₱14,000 | – | ₱14,000 | ₱2,100 | – | ₱2,100 |

| 14,250 – 14,749.99 | ₱14,500 | – | ₱14,500 | ₱2,175 | – | ₱2,175 |

| 14,750 – 15,249.99 | ₱15,000 | – | ₱15,000 | ₱2,250 | – | ₱2,250 |

| 15,250 – 15,749.99 | ₱15,500 | – | ₱15,500 | ₱2,325 | – | ₱2,325 |

| 15,750 – 16,249.99 | ₱16,000 | – | ₱16,000 | ₱2,400 | – | ₱2,400 |

| 16,250 – 16,749.99 | ₱16,500 | – | ₱16,500 | ₱2,475 | – | ₱2,475 |

| 16,750 – 17,249.99 | ₱17,000 | – | ₱17,000 | ₱2,550 | – | ₱2,550 |

| 17,250 – 17,749.99 | ₱17,500 | – | ₱17,500 | ₱2,625 | – | ₱2,625 |

| 17,750 – 18,249.99 | ₱18,000 | – | ₱18,000 | ₱2,700 | – | ₱2,700 |

| 18,250 – 18,749.99 | ₱18,500 | – | ₱18,500 | ₱2,775 | – | ₱2,775 |

| 18,750 – 19,249.99 | ₱19,000 | – | ₱19,000 | ₱2,850 | – | ₱2,850 |

| 19,250 – 19,749.99 | ₱19,500 | – | ₱19,500 | ₱2,925 | – | ₱2,925 |

| 19,750 – 20,249.99 | ₱20,000 | – | ₱20,000 | ₱3,000 | – | ₱3,000 |

| 20,250 – 20,749.99 | ₱20,000 | ₱500 | ₱20,500 | ₱3,000 | ₱75 | ₱3,075 |

| 20,750 – 21,249.99 | ₱20,000 | ₱1,000 | ₱21,000 | ₱3,000 | ₱150 | ₱3,150 |

| 21,250 – 21,749.99 | ₱20,000 | ₱1,500 | ₱21,500 | ₱3,000 | ₱225 | ₱3,225 |

| 21,750 – 22,249.99 | ₱20,000 | ₱2,000 | ₱22,000 | ₱3,000 | ₱300 | ₱3,300 |

| 22,250 – 22,749.99 | ₱20,000 | ₱2,500 | ₱22,500 | ₱3,000 | ₱375 | ₱3,375 |

| 22,750 – 23,249.99 | ₱20,000 | ₱3,000 | ₱23,000 | ₱3,000 | ₱450 | ₱3,450 |

| 23,250 – 23,749.99 | ₱20,000 | ₱3,500 | ₱23,500 | ₱3,000 | ₱525 | ₱3,525 |

| 23,750 – 24,249.99 | ₱20,000 | ₱4,000 | ₱24,000 | ₱3,000 | ₱600 | ₱3,600 |

| 24,250 – 24,749.99 | ₱20,000 | ₱4,500 | ₱24,500 | ₱3,000 | ₱675 | ₱3,675 |

| 24,750 – 25,249.99 | ₱20,000 | ₱5,000 | ₱25,000 | ₱3,000 | ₱750 | ₱3,750 |

| 25,250 – 25,749.99 | ₱20,000 | ₱5,500 | ₱25,500 | ₱3,000 | ₱825 | ₱3,825 |

| 25,750 – 26,249.99 | ₱20,000 | ₱6,000 | ₱26,000 | ₱3,000 | ₱900 | ₱3,900 |

| 26,250 – 26,749.99 | ₱20,000 | ₱6,500 | ₱26,500 | ₱3,000 | ₱975 | ₱3,975 |

| 26,750 – 27,249.99 | ₱20,000 | ₱7,000 | ₱27,000 | ₱3,000 | ₱1,050 | ₱4,050 |

| 27,250 – 27,749.99 | ₱20,000 | ₱7,500 | ₱27,500 | ₱3,000 | ₱1,125 | ₱4,125 |

| 27,750 – 28,249.99 | ₱20,000 | ₱8,000 | ₱28,000 | ₱3,000 | ₱1,200 | ₱4,200 |

| 28,250 – 28,749.99 | ₱20,000 | ₱8,500 | ₱28,500 | ₱3,000 | ₱1,275 | ₱4,275 |

| 28,750 – 29,249.99 | ₱20,000 | ₱9,000 | ₱29,000 | ₱3,000 | ₱1,350 | ₱4,350 |

| 29,250 – 29,749.99 | ₱20,000 | ₱9,500 | ₱29,500 | ₱3,000 | ₱1,425 | ₱4,425 |

| 29,750 – 30,249.99 | ₱20,000 | ₱10,000 | ₱30,000 | ₱3,000 | ₱1,500 | ₱4,500 |

| 30,250 – 30,749.99 | ₱20,000 | ₱10,500 | ₱30,500 | ₱3,000 | ₱1,575 | ₱4,575 |

| 30,750 – 31,249.99 | ₱20,000 | ₱11,000 | ₱31,000 | ₱3,000 | ₱1,650 | ₱4,650 |

| 31,250 – 31,749.99 | ₱20,000 | ₱11,500 | ₱31,500 | ₱3,000 | ₱1,725 | ₱4,725 |

| 31,750 – 32,249.99 | ₱20,000 | ₱12,000 | ₱32,000 | ₱3,000 | ₱1,800 | ₱4,800 |

| 32,250 – 32,749.99 | ₱20,000 | ₱12,500 | ₱32,500 | ₱3,000 | ₱1,875 | ₱4,875 |

| 32,750 – 33,249.99 | ₱20,000 | ₱13,000 | ₱33,000 | ₱3,000 | ₱1,950 | ₱4,950 |

| 33,250 – 33,749.99 | ₱20,000 | ₱13,500 | ₱33,500 | ₱3,000 | ₱2,025 | ₱5,025 |

| 33,750 – 34,249.99 | ₱20,000 | ₱14,000 | ₱34,000 | ₱3,000 | ₱2,100 | ₱5,100 |

| 34,250 – 34,749.99 | ₱20,000 | ₱14,500 | ₱34,500 | ₱3,000 | ₱2,175 | ₱5,175 |

| 34,750 – Over | ₱20,000 | ₱15,000 | ₱35,000 | ₱3,000 | ₱2,250 | ₱5,250 |

Source: (click to open)

Related Posts

- SSS Contribution Table 2025 – Detailed Guide

- SSS Contribution Table for Self-Employed

- SSS Contribution Table for Employees and Employers

- SSS Contribution Table for Voluntary and Non-Working Spouses

- SSS Contribution Table for Household Employers and Kasambahays

- Making SSS Contribution Payments Easier Through Partner Channels

- How to Pay SSS Contributions in Bayad Center?

To determine your premium payment based on a monthly salary of ₱19,500, simply locate the row labeled ₱19,250 – ₱19,749.99 in the first column of the Compensation Range. Your premium payment in this situation would be ₱2,925.

Understanding the Mandatory Provident Fund (MPF) for OFWs

The Mandatory Provident Fund (MPF) is an additional savings program that applies to OFWs earning more than ₱20,000 monthly. It provides extra retirement, disability, and death benefits on top of the regular SSS benefits. The MPF contribution ranges from ₱75 to ₱2,250 monthly, depending on your salary bracket. This fund helps ensure better financial security for OFWs and their families upon retirement or in case of unforeseen circumstances.

I’m an OFW. Can my family members in the Philippines contribute to My Behalf?

Assigning a representative back home to contribute to OFWs is a viable option for securing their social security benefits.

Family members in the Philippines can contribute on behalf of OFWs, provided that the necessary payment details are given and posted contributions are regularly monitored to ensure remittance to the SSS.

This option is particularly useful for OFWs who do not have the time or capacity to pay their contributions themselves.

There are two main payment options for family members who wish to contribute on behalf of OFWs: overseas remittance or paying at any SSS-accredited collecting partner in the Philippines.

To ensure that contributions are properly credited to the OFW’s account, the family member must provide supporting documents, such as the OFW’s PRN (Payment Reference Number) and other payment details.

It is also important for the OFW to regularly monitor their posted contributions to ensure that they are properly remitted to the SSS.

By taking these steps, OFWs can ensure that they are able to secure their social security benefits even while working abroad. Also, this makes them eligible for pension benefits, for which you can calculate the amount with the SSS Pension Calculator.

Bilateral Social Security Agreements for Overseas Filipino Workers (OFWs)

Bilateral Social Security Agreements (BLSAs) are crucial for Overseas Filipino Workers (OFWs) as they enhance their social security protection while working abroad. These agreements are designed to ensure that Filipino workers receive fair treatment regarding social security benefits in the host countries where they are employed. Here’s an overview based on the provided search results:

Purpose of Bilateral Social Security Agreements

- Equality of Treatment: BLSAs ensure that OFWs receive social security benefits under the same conditions as nationals of the host country, eliminating discrimination based on nationality.

- Export of Benefits: These agreements allow OFWs to continue receiving their social security benefits even after returning to the Philippines or moving to another country.

- Totalization of Insurance Periods: BLSAs facilitate the combination of creditable periods of contributions made in both the host country and the Philippines. This helps determine eligibility for benefits and allows for a proportional sharing of benefits based on contributions from both countries.

- Mutual Administrative Assistance: The agreements promote coordination between the social security institutions of the Philippines and the host countries, helping OFWs navigate their rights and benefits more easily.\

To date, the Philippines has established the following SSAs:

| Country | Entry into Force | Agreement/Convention |

|---|---|---|

| Austria | 1 April 1982 | PH-Austria Convention, PH-Austria Supplementary |

| Belgium | 1 August 2005 | PH-Belgium Convention |

| Canada | 1 March 1997 | PH-Canada Agreement, PH-Canada Supplementary |

| Denmark | 1 December 2015 | PH-Denmark Agreement |

| France | 1 November 1994 | PH-France Convention |

| Germany | 1 June 2018 | PH-Germany SSA |

| Japan | 1 August 2018 | PH-Japan SSA |

| Korea | 1 April 2024 | PH-KR SSA |

| Luxembourg | 1 January 2020 | PH-Luxembourg SAA |

| Netherlands | 10 April 2001 | PH-Netherlands AA, PH-Netherlands-Protocol |

| Portugal | 1 October 2017 | PH-Portugal SSA |

| Quebec | 1 November 1998 | PH-Quebec Understanding, PH-Quebec Amendment |

| Spain | 1 October 1989 | PH-Spain Convention, PH-Spain Amendment |

| Sweden | 1 November 2019 | PH-Sweden SSA |

| Switzerland | 1 March 2004 | PH-Switzerland Agreement |

| UK and Northern Ireland | 1 December 1989 | PH-UK SSA |

I stop paying my SSS contribution last 2021. To continue, do I have to pay the years that I haven’t paid?

Thanks.

To continue your SSS contributions after stopping in 2021, you do not need to pay for the years you missed. You can resume your contributions by changing your status to generating a Payment Reference Number (PRN) for your current payments.

If you wish to maintain your eligibility for certain benefits, it is advisable to resume your contributions as soon as possible.

I want to continue my sss contribution. Last i paid was 2017. Do i need to pay from 2018 or i can start paying this september 2024 onwards to update my contribution? And how will i know how much im supposed to pay for monthly contribution? Do i need to send a request or something to update my records?

To continue contributing to SSS after a break from 2017, you can begin paying from September 2024 onward without having to pay for missed years (2018 through 2023). However, it is recommended that you check with SSS to see if there are any penalties that require payment.

To make your payments, you will need a Payment Reference Number (PRN). You can obtain this through the SSS website, via text, or email.

You do not necessarily need to send a formal request to update your records, but it’s a good practice to inform SSS of your intention to resume contributions. You can do this by visiting an SSS office or contacting their customer service.

Hello i am an ofw po. 2012 pa last contribution ko sa SSS. now i am 3 months pregnant, EDD april 2025. To qualify for maternity benefits can you assist me anong better option.

Make at least three contributions between April 2024 and March 2025. Choose the highest MSC (₱30,000, increasing to ₱35,000 in 2025) to maximize your benefit. Submit MAT-1 and proof of pregnancy. Understand that higher MSC leads to higher benefits.

I’m based in Dubai. Ang sinasabi po ng mga counter dito is PHP 3,000 lang daw ang max pag OFW. Then nag check po ako sa SSS app as I’m planning to pay via Credit Card. Nag create ako ng OFW PRN contribution and the max is 5,250 ano po ba ang dapat sundin? at ano po magiging difference sa contribution at pension?

To clarify the correct contribution amount:

Higher contributions will result in better pension and other SSS benefits in the future.

The ₱3,000 mentioned at the counter refers only to the basic SSS contribution, but this is not the complete amount for your salary range.

For OFWs when is the last day for the remittance of contribution, say July 2024 to December 2024. Is it January 31, 2025? I can’t create a PRN (on the website as well as on mobile) for that period, it says: “Invalid month, check due date.” I sent an email to usssaptayo@sss.gov.ph. Hopefully they can address or clarify the issue.

I’m almost of retirement age and been contributing for the last 38years. been paying the maximum amount and currently paying P5280. when I use the pension calculator, I got >P29K pension if i retire at 60y. is it correct that I’m entitled to that amount or there is a capped of certain max amount?

Hi! You can read How much is the maximum SSS pension in the Philippines? or calculate here