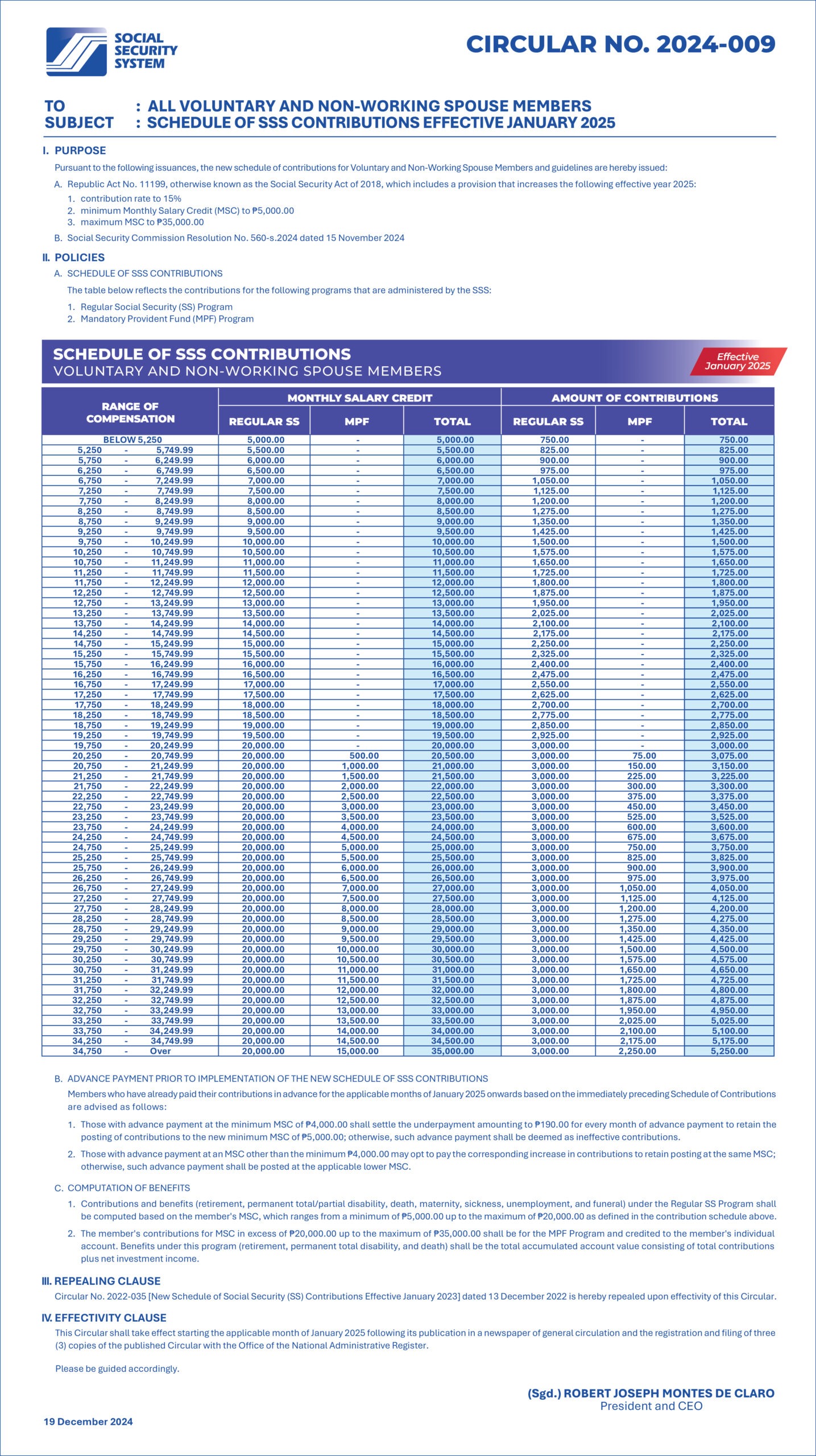

SSS Contribution Table for Voluntary and Non-Working Spouses in 2025

The SSS contribution table for voluntary and non-working spouses is a guide that outlines the monthly contribution rates for those not required to pay mandatory SSS contributions.

This includes voluntary members who have chosen to enroll in the SSS program, as well as non-working spouses of SSS members who are not gainfully employed.

The contribution table provides a clear and concise breakdown of the different contribution rates based on the monthly salary credit of the individual.

It is important for voluntary and non-working spouses to understand and abide by the contribution rates outlined in the table to ensure their eligibility for SSS benefits.

SSS Contributions for Voluntary and Non-Working Spouses Table in 2025

| Range of Compensation | Monthly Salary Credit | Amount of Contributions | ||||

|---|---|---|---|---|---|---|

| Regular SS | MPF | Total | Regular SS | MPF | Total | |

| Below 5,000 | ₱5,000 | – | ₱5,000 | ₱750 | – | ₱750 |

| 5,000 – 5,749.99 | ₱5,500 | – | ₱5,500 | ₱825 | – | ₱825 |

| 5,750 – 6,249.99 | ₱6,000 | – | ₱6,000 | ₱900 | – | ₱900 |

| 6,250 – 6,749.99 | ₱6,500 | – | ₱6,500 | ₱975 | – | ₱975 |

| 6,750 – 7,249.99 | ₱7,000 | – | ₱7,000 | ₱1,050 | – | ₱1,050 |

| 7,250 – 7,749.99 | ₱7,500 | – | ₱7,500 | ₱1,125 | – | ₱1,125 |

| 7,750 – 8,249.99 | ₱8,000 | – | ₱8,000 | ₱1,200 | – | ₱1,200 |

| 8,250 – 8,749.99 | ₱8,500 | – | ₱8,500 | ₱1,275 | – | ₱1,275 |

| 8,750 – 9,249.99 | ₱9,000 | – | ₱9,000 | ₱1,350 | – | ₱1,350 |

| 9,250 – 9,749.99 | ₱9,500 | – | ₱9,500 | ₱1,425 | – | ₱1,425 |

| 9,750 – 10,249.99 | ₱10,000 | – | ₱10,000 | ₱1,500 | – | ₱1,500 |

| 10,250 – 10,749.99 | ₱10,500 | – | ₱10,500 | ₱1,575 | – | ₱1,575 |

| 10,750 – 11,249.99 | ₱11,000 | – | ₱11,000 | ₱1,650 | – | ₱1,650 |

| 11,250 – 11,749.99 | ₱11,500 | – | ₱11,500 | ₱1,725 | – | ₱1,725 |

| 11,750 – 12,249.99 | ₱12,000 | – | ₱12,000 | ₱1,800 | – | ₱1,800 |

| 12,250 – 12,749.99 | ₱12,500 | – | ₱12,500 | ₱1,875 | – | ₱1,875 |

| 12,750 – 13,249.99 | ₱13,000 | – | ₱13,000 | ₱1,950 | – | ₱1,950 |

| 13,250 – 13,749.99 | ₱13,500 | – | ₱13,500 | ₱2,025 | – | ₱2,025 |

| 13,750 – 14,249.99 | ₱14,000 | – | ₱14,000 | ₱2,100 | – | ₱2,100 |

| 14,250 – 14,749.99 | ₱14,500 | – | ₱14,500 | ₱2,175 | – | ₱2,175 |

| 14,750 – 15,249.99 | ₱15,000 | – | ₱15,000 | ₱2,250 | – | ₱2,250 |

| 15,250 – 15,749.99 | ₱15,500 | – | ₱15,500 | ₱2,325 | – | ₱2,325 |

| 15,750 – 16,249.99 | ₱16,000 | – | ₱16,000 | ₱2,400 | – | ₱2,400 |

| 16,250 – 16,749.99 | ₱16,500 | – | ₱16,500 | ₱2,475 | – | ₱2,475 |

| 16,750 – 17,249.99 | ₱17,000 | – | ₱17,000 | ₱2,550 | – | ₱2,550 |

| 17,250 – 17,749.99 | ₱17,500 | – | ₱17,500 | ₱2,625 | – | ₱2,625 |

| 17,750 – 18,249.99 | ₱18,000 | – | ₱18,000 | ₱2,700 | – | ₱2,700 |

| 18,250 – 18,749.99 | ₱18,500 | – | ₱18,500 | ₱2,775 | – | ₱2,775 |

| 18,750 – 19,249.99 | ₱19,000 | – | ₱19,000 | ₱2,850 | – | ₱2,850 |

| 19,250 – 19,749.99 | ₱19,500 | – | ₱19,500 | ₱2,925 | – | ₱2,925 |

| 19,750 – 20,249.99 | ₱20,000 | – | ₱20,000 | ₱3,000 | – | ₱3,000 |

| 20,250 – 20,749.99 | ₱20,000 | ₱500 | ₱20,500 | ₱3,000 | ₱75 | ₱3,075 |

| 20,750 – 21,249.99 | ₱20,000 | ₱1,000 | ₱21,000 | ₱3,000 | ₱150 | ₱3,150 |

| 21,250 – 21,749.99 | ₱20,000 | ₱1,500 | ₱21,500 | ₱3,000 | ₱225 | ₱3,225 |

| 21,750 – 22,249.99 | ₱20,000 | ₱2,000 | ₱22,000 | ₱3,000 | ₱300 | ₱3,300 |

| 22,250 – 22,749.99 | ₱20,000 | ₱2,500 | ₱22,500 | ₱3,000 | ₱375 | ₱3,375 |

| 22,750 – 23,249.99 | ₱20,000 | ₱3,000 | ₱23,000 | ₱3,000 | ₱450 | ₱3,450 |

| 23,250 – 23,749.99 | ₱20,000 | ₱3,500 | ₱23,500 | ₱3,000 | ₱525 | ₱3,525 |

| 23,750 – 24,249.99 | ₱20,000 | ₱4,000 | ₱24,000 | ₱3,000 | ₱600 | ₱3,600 |

| 24,250 – 24,749.99 | ₱20,000 | ₱4,500 | ₱24,500 | ₱3,000 | ₱675 | ₱3,675 |

| 24,750 – 25,249.99 | ₱20,000 | ₱5,000 | ₱25,000 | ₱3,000 | ₱750 | ₱3,750 |

| 25,250 – 25,749.99 | ₱20,000 | ₱5,500 | ₱25,500 | ₱3,000 | ₱825 | ₱3,825 |

| 25,750 – 26,249.99 | ₱20,000 | ₱6,000 | ₱26,000 | ₱3,000 | ₱900 | ₱3,900 |

| 26,250 – 26,749.99 | ₱20,000 | ₱6,500 | ₱26,500 | ₱3,000 | ₱975 | ₱3,975 |

| 26,750 – 27,249.99 | ₱20,000 | ₱7,000 | ₱27,000 | ₱3,000 | ₱1,050 | ₱4,050 |

| 27,250 – 27,749.99 | ₱20,000 | ₱7,500 | ₱27,500 | ₱3,000 | ₱1,125 | ₱4,125 |

| 27,750 – 28,249.99 | ₱20,000 | ₱8,000 | ₱28,000 | ₱3,000 | ₱1,200 | ₱4,200 |

| 28,250 – 28,749.99 | ₱20,000 | ₱8,500 | ₱28,500 | ₱3,000 | ₱1,275 | ₱4,275 |

| 28,750 – 29,249.99 | ₱20,000 | ₱9,000 | ₱29,000 | ₱3,000 | ₱1,350 | ₱4,350 |

| 29,250 – 29,749.99 | ₱20,000 | ₱9,500 | ₱29,500 | ₱3,000 | ₱1,425 | ₱4,425 |

| 29,750 – 30,249.99 | ₱20,000 | ₱10,000 | ₱30,000 | ₱3,000 | ₱1,500 | ₱4,500 |

| 30,250 – 30,749.99 | ₱20,000 | ₱10,500 | ₱30,500 | ₱3,000 | ₱1,575 | ₱4,575 |

| 30,750 – 31,249.99 | ₱20,000 | ₱11,000 | ₱31,000 | ₱3,000 | ₱1,650 | ₱4,650 |

| 31,250 – 31,749.99 | ₱20,000 | ₱11,500 | ₱31,500 | ₱3,000 | ₱1,725 | ₱4,725 |

| 31,750 – 32,249.99 | ₱20,000 | ₱12,000 | ₱32,000 | ₱3,000 | ₱1,800 | ₱4,800 |

| 32,250 – 32,749.99 | ₱20,000 | ₱12,500 | ₱32,500 | ₱3,000 | ₱1,875 | ₱4,875 |

| 32,750 – 33,249.99 | ₱20,000 | ₱13,000 | ₱33,000 | ₱3,000 | ₱1,950 | ₱4,950 |

| 33,250 – 33,749.99 | ₱20,000 | ₱13,500 | ₱33,500 | ₱3,000 | ₱2,025 | ₱5,025 |

| 33,750 – 34,249.99 | ₱20,000 | ₱14,000 | ₱34,000 | ₱3,000 | ₱2,100 | ₱5,100 |

| 34,250 – 34,749.99 | ₱20,000 | ₱14,500 | ₱34,500 | ₱3,000 | ₱2,175 | ₱5,175 |

| 34,750 and above | ₱20,000 | ₱15,000 | ₱35,000 | ₱3,000 | ₱2,250 | ₱5,250 |

Source (click to show)

Related Posts

- SSS Contribution Table 2025 – Complete Guide

- SSS Contribution Table for Self Employed

- SSS Contribution Table for OFW

- SSS Contribution Table for Employees and Employers

- SSS Contribution Table for Household Employers and Kasambahays

- Making SSS Contribution Payments Easier Through Partner Channels

- How to Pay SSS Contributions in Bayad Center?

Eligibility for Voluntary and Non-Working Spouse Membership in the SSS

To be eligible for voluntary and non-working spouse membership in the Social Security System (SSS), the individual must meet certain requirements.

For Voluntary Membership

To be eligible for voluntary membership, the individual must be at least 18 years old and not more than 60 years old.

The individual must also not be an employee, self-employed, or overseas Filipino worker who is required to pay SSS contributions.

For Non-Working Spouse Member

To be eligible as a non-working spouse member individual must be married to a primary SSS member who is paying regular contributions to the SSS.

The individual must not be employed or receive regular income from any other source.

Both voluntary and non-working spouse members are eligible to receive certain benefits from the SSS, such as sickness, disability, death, and 70K SSS Maternity benefits.

Contribution Rates for Voluntary and Non-Working Spouses

For voluntary and non-working spouses, the monthly contribution rate is 15%. The amount of contributions may vary depending on the individual’s monthly salary credit.

It includes Regular Social Security and the Mandatory Provident Fund (MPF) amount.

- For example, the amount of contribution for voluntary and non-working spouses having a monthly income of PHP 10,000 is PHP 1,500. Similarly, for the voluntary and non-working spouses having a monthly income of PHP 20,000, the monthly contribution is PHP 3,000.

- But if they have a monthly salary credit of PHP 21,000 where Regular Social Security is PHP 20,000 and MPF is PHP 1,000, the monthly contribution is PHP 3,150.

For Voluntary and Non-working spouses, the range of compensation to compute the contribution is Below PHP 5,000 to PHP 34,750 and above. The amount of contribution ranges from PHP 750 to PHP 5,250 per month.

Calculate your SSS Contributions for Voluntary and Non-Working Spouse Membership with our SSS Contribution Calculator.

Advance Payment Prior to Implementation of the New Schedule

Members who have already paid their contributions in advance for the applicable months of January 2025 onwards based on the immediately preceding Schedule of Contributions are advised as follows:

- Those with advance payment at the minimum MSC of P4,000.00 shall settle the underpayment amounting to P190.00 for every month of advance payment to retain the posting of contributions in the new minimum MSC of P5,000.00; otherwise, such advance payment shall be deemed as insufficient contribution.

- Those with advance payment at an MSC other than the minimum P4,000.00 may opt to pay the corresponding increase in contributions to retain posting at the same MSC; otherwise, such advance payment shall be posted at the applicable lower MSC.

Benefits of Voluntary Contributions for Non-Working Spouses

Voluntary and non-working spouse members may be eligible to receive the following benefits:

1. Retirement Benefits

Voluntary and non-working spouse members who meet the eligibility criteria may be eligible to receive a monthly pension after they reach retirement age. Calculate the amount with the SSS Retirement Calculator.

2. Disability Benefits

If a voluntary or non-working spouse member becomes disabled, they may be eligible to receive a monthly pension to help cover the costs of their medical treatment and other expenses.

3. Death Benefits

If a voluntary or non-working spouse member passes away, their families may be eligible to receive a lump sum payment to help cover funeral expenses and other costs.

In order to receive these benefits, voluntary and non-working spouse members must have made the required number of contributions and meet other eligibility criteria.

It is always a good idea to check with the SSS directly to determine your specific eligibility for benefits.

Frequently Asked Questions about Voluntary and Non-Working Spouse Contributions

1. What is a Voluntary Contribution for a Non-Working Spouse?

A voluntary contribution is a payment made to SSS by a non-working spouse who is not required to make mandatory contributions. These contributions allow non-working spouses to access SSS benefits and secure their social security protection.

2. Can I still claim maternity benefits as an OFW if my last contribution was several years ago?

Yes, you can still qualify for SSS maternity benefits if you meet the following requirements:

- Make at least 3 monthly contributions within 12 months before the semester of childbirth

- File MAT-1 (Maternity Notification) and MAT-2 (Maternity Reimbursement) forms within the prescribed periods

- The benefit amount will depend on your average Monthly Salary Credit (MSC) and total contributions

3. Can I resume SSS contributions after a long gap in payments?

Yes, you can resume paying SSS contributions as a voluntary member at any age before 60. You will remain eligible for benefits, including retirement, provided you have at least 120 monthly contributions before reaching retirement age (60 years old). You can choose your Monthly Salary Credit (MSC) based on the current contribution schedule.

4. Can I pay SSS contributions retroactively for missed months?

No, SSS does not allow retroactive payment of missed contributions. You can only make payments for the current and future months to maintain your membership and eligibility for benefits.

5. How do I start paying SSS contributions if I have an SSS number but no previous contributions?

If you have an SSS number but haven’t made any contributions, you can:

- Visit your nearest SSS office to register as a voluntary or self-employed member

- For self-employed members, contributions are based on your declared monthly income

- Choose your Monthly Salary Credit (MSC) from the contribution table based on your income

- Start making regular monthly contributions to ensure access to SSS benefits

6. How do I file for maternity benefits (MAT-1 and MAT-2)?

To file for maternity benefits:

- Submit MAT-1 (Maternity Notification) form within 60 days from the start of your pregnancy

- File MAT-2 (Maternity Benefit Reimbursement) form within 1 year from the date of childbirth

- Ensure you meet the minimum contribution requirements

- Submit required supporting documents such as pregnancy verification and child’s birth certificate

7. Can Non-Working Spouses Apply for Voluntary Contributions on their Own?

Yes, non-working spouses can apply for voluntary contributions on their own by visiting any SSS branch and registering as a voluntary member.

8. Can Voluntary Contributors Receive the Same Benefits as Regular Contributors?

Yes, voluntary contributors can receive the same SSS benefits as regular contributors, including sickness, disability, death, and maternity benefits, provided they meet the qualifying conditions for each benefit type.

9. How long do Non-Working Spouses need to Contribute before they are Eligible for Benefits?

The required contribution period varies by benefit type:

- For retirement: at least 120 monthly contributions prior to the semester of retirement

- For maternity: at least 3 monthly contributions within 12 months before the semester of childbirth

- For sickness and disability: a minimum number of monthly contributions as specified by SSS

10. What documents are needed to register as a voluntary member?

To register as a voluntary member, you need to provide:

- At least one valid government-issued ID

- Marriage certificate (for non-working spouse membership)

- Properly filled-out SSS forms

- Other supporting documents as may be required by SSS

Conclusion

The Social Security System (SSS) is a government-run program that provides social security benefits to eligible members in the Philippines.

Contributions to the SSS are made by both the employee and the employer, with the aim of providing financial protection for members in the event of illness, disability, old age, or death.

Non-working spouses are also allowed to make voluntary contributions to the SSS. These contributions can help non-working spouses become eligible for social security benefits, such as retirement, disability, and survivor’s pensions.

It is important for both working and non-working spouses to understand the contribution table and stay up-to-date on any changes to the SSS program.

This can help ensure that they are making the appropriate contributions and are eligible for the social security benefits they may need in the future.