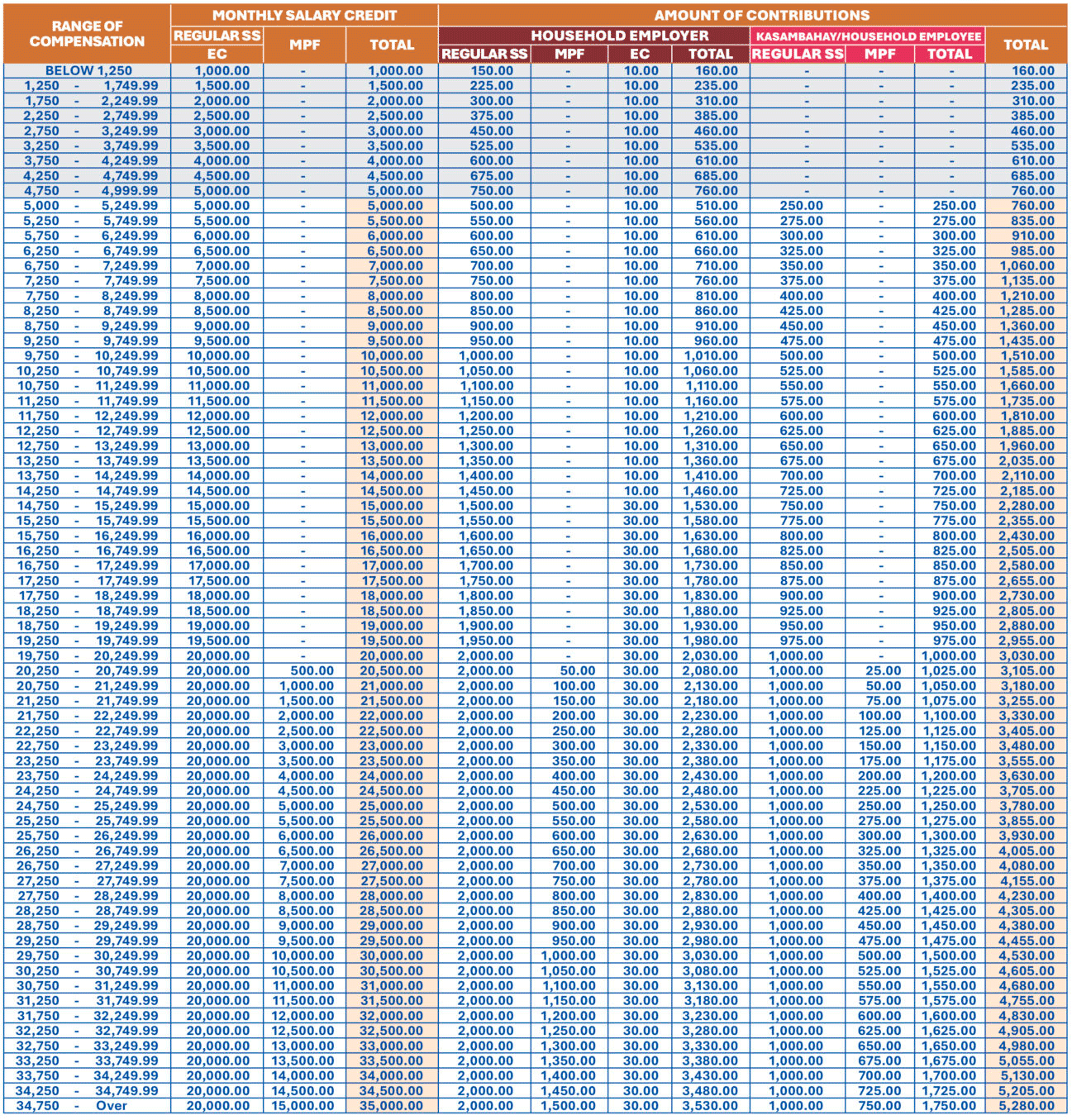

SSS Contribution Table for Household Employers and Kasambahays in 2025

The SSS Contribution Table for Household Employers and Kasambahays provides a comprehensive guide to making contributions to the SSS. The table lists the required contributions for both Household Employers and Kasambahays, effective January 2025. It also provides information on the different rates and the different types of contributions that are required.

Related Posts

- SSS Contribution Table for Self Employed

- SSS Contribution Table for OFW

- SSS Contribution Table for Employees and Employers

- SSS Contribution Table for Voluntary and Non-Working Spouses

- Making SSS Contribution Payments Easier Through Partner Channels

- How to Pay SSS Contributions in Bayad Center?

Key Updates for 2025

According to Circular No. 2024-007, several important changes have been implemented for 2025:

- The contribution rate has been increased to 15%

- The maximum Monthly Salary Credit (MSC) has been set to P35,000.00

- The schedule includes Regular Social Security (SS) Program, Employees’ Compensation (EC) Program, and Mandatory Provident Fund (MPF) Program contributions

Eligibility Requirements for Household Employers and Kasambahays

Household employers and kasambahays are those who are employed by a household or a family.

- Household employers are responsible for providing their workers with the necessary benefits and wages that are required by law.

- Kasambahays, on the other hand, are those employed by a kasambahay agency or by a kasambahay service provider.

In order to be eligible to contribute to the SSS, Household Employers, and Kasambahays must meet the following qualifications and requirements:

Household Employers

- Must be a Filipino citizen

- Must have paid employees in the home

- Must register with the SSS

- Must pay SSS contributions

Kasambahays

- Must be a Filipino citizen

- Must be employed in the home

- Must register with the SSS

- Must pay SSS contributions

Registering to My.SSS as a Household Employer

To register as a household employer on the My.SSS platform, follow these streamlined steps:

- Visit the SSS Website: Navigate to www.sss.gov.ph.

- Complete the CAPTCHA: Click “I’m not a robot” and answer the CAPTCHA to proceed.

- Select Employer Login: On the homepage, click on the Employer Login tab. If you are a new household employer, select “Household Employer” under “Not yet registered in My.SSS?”

- Fill Out the Online User ID Registration Form: Complete the required fields in the registration form, ensuring that all information matches your SSS records.

- Submit Your Information: After filling out the form, click “Submit.” A prompt will remind you to check your spam or junk mail folder if you do not receive an email notification from SSS.

- Wait for Email Notification: You will receive an email from SSS containing a link for the next phase of the registration process.

- Activate Your Account: Follow the instructions in the email to set your password and gain access to your My.SSS account.

Additional Information

Once registered, you can manage contributions for your household employees and access various SSS services online. It’s important to ensure that all details are accurate to avoid any issues with your registration. If you have further questions or need assistance, consider reaching out to SSS customer service for support.

How to Calculate SSS Contributions for Household Employers and Kasambahays

To calculate SSS contributions for household employers and kasambahays, you will need to know the monthly salary of the kasambahay and refer to the contribution table effective January 2025. The monthly salary of the kasambahay is the total amount that the household employer pays the kasambahay for the services rendered within a month.

The contribution schedule has been updated to reflect the following components:

- Regular Social Security (SS) Program

- Employees’ Compensation (EC) Program

- Mandatory Provident Fund (MPF) Program

The table provides specific contribution amounts based on the Monthly Salary Credit (MSC) range, which now extends up to P35,000.00. Each salary range corresponds to predetermined contribution amounts for both the employer and employee.

For example, if a kasambahay earns P5,000 monthly, you can refer to the contribution table to find the corresponding contribution amounts for both the employer and the kasambahay.

Check your monthly SSS contribution now with SSS Contribution Calculator!

It is important to note that the SSS contributions must be paid by both the household employer and the kasambahay according to their respective shares as shown in the contribution table. The household employer is responsible for remitting the total contribution to SSS, which includes both the employer and employee shares.

Computation of Benefits for 2025

According to Circular No. 2024-007, the computation of benefits has been updated with the following guidelines:

- Contributory benefits (retirement, permanent total/partial disability, death, maternity, sickness, unemployment, and funeral) under the Regular SS and EC Programs shall be computed based on the member’s MSC, which ranges from a minimum of P1,000.00 up to the maximum of P35,000.00

- For MSC exceeding P20,000.00 up to P35,000.00, contributions shall be allocated to the MPF Program and credited to the member’s individual account

- Benefits under this program (retirement, permanent total disability, and death) shall be the total accumulated account value consisting of total contributions plus net investment income

Benefits of SSS Contribution Table for Household Employers and Kasambahays

The SSS Contribution Table provides several benefits to Household Employers and Kasambahays.

- It allows employers to easily calculate the SSS contribution for their employees. This eliminates the need to manually compute the contribution rate.

- The contribution table helps to ensure that employees receive the correct amount of SSS benefits.

- The contribution table also ensures that employers are contributing the correct amount to the SSS.

- With the updated 2025 rates, it provides better social security coverage with increased contribution ceilings.

You can also check the contribution rates for the other types of monthly contributions with the latest SSS contribution table.

Conclusion

The updated SSS Contribution Table for 2025 reflects important changes in contribution rates and maximum Monthly Salary Credit. It continues to serve as an essential tool for Household Employers and Kasambahays, ensuring proper social security coverage and benefits for household employees.

By following the new contribution schedule effective January 2025, employers can ensure that their employees are properly provided for in the event of death, disability, sickness, maternity, and old age, while complying with the latest SSS regulations.

Sss requires to submit monthly contributions thru the USB. What if we don’t own the particular app in the USB

SSS does not require the submission of monthly contributions only through USB. Instead, there are several options available for submitting monthly contributions such as online payment through the SSS website, payment through accredited banks and payment centers, and submission of payment through the SSS mobile app.

However, if you still encounter any issues with the payment process, you may contact the SSS or visit their website for assistance and further information on payment options.

Our helpers contributions are being paid on my dad’s SSS number which is an employer account. Is that the right way to do it? When I checked the account, there was no record of the name of our helper. How would the helper get claims?

Paying your helpers’ SSS contributions under your dad’s employer account is not the correct approach. If there is no record of your helper’s name under your dad’s SSS account, they may face difficulties in claiming benefits.

Register Your Helper. You can visit the nearest SSS branch or register online. Ensure that all future contributions are paid under their individual SSS number. You may need to consult with SSS on how to rectify any past contributions made incorrectly.

How can I pay the SSS contribution of my sister if she is working from overseas and cannot go to the office abroad? Please assist. Thank you!

If your sister has access to online banking, she can pay her dues through the SSS Online. A family member can also pay on her behalf. To do this, you need to provide the necessary details such as your sister’s payment reference number (PRN) and the amount to be paid.

if i only have 1 kasambahay. do i have to register myself as employer under sss law?