SSS Contribution Table for Employees and Employers in 2025

With the ever-changing landscape of payroll taxes, employers and employees are often left wondering how much they need to contribute to social security. In order to make this process easier, Social Security System Philippines has created the SSS Contribution table for employers and employees.

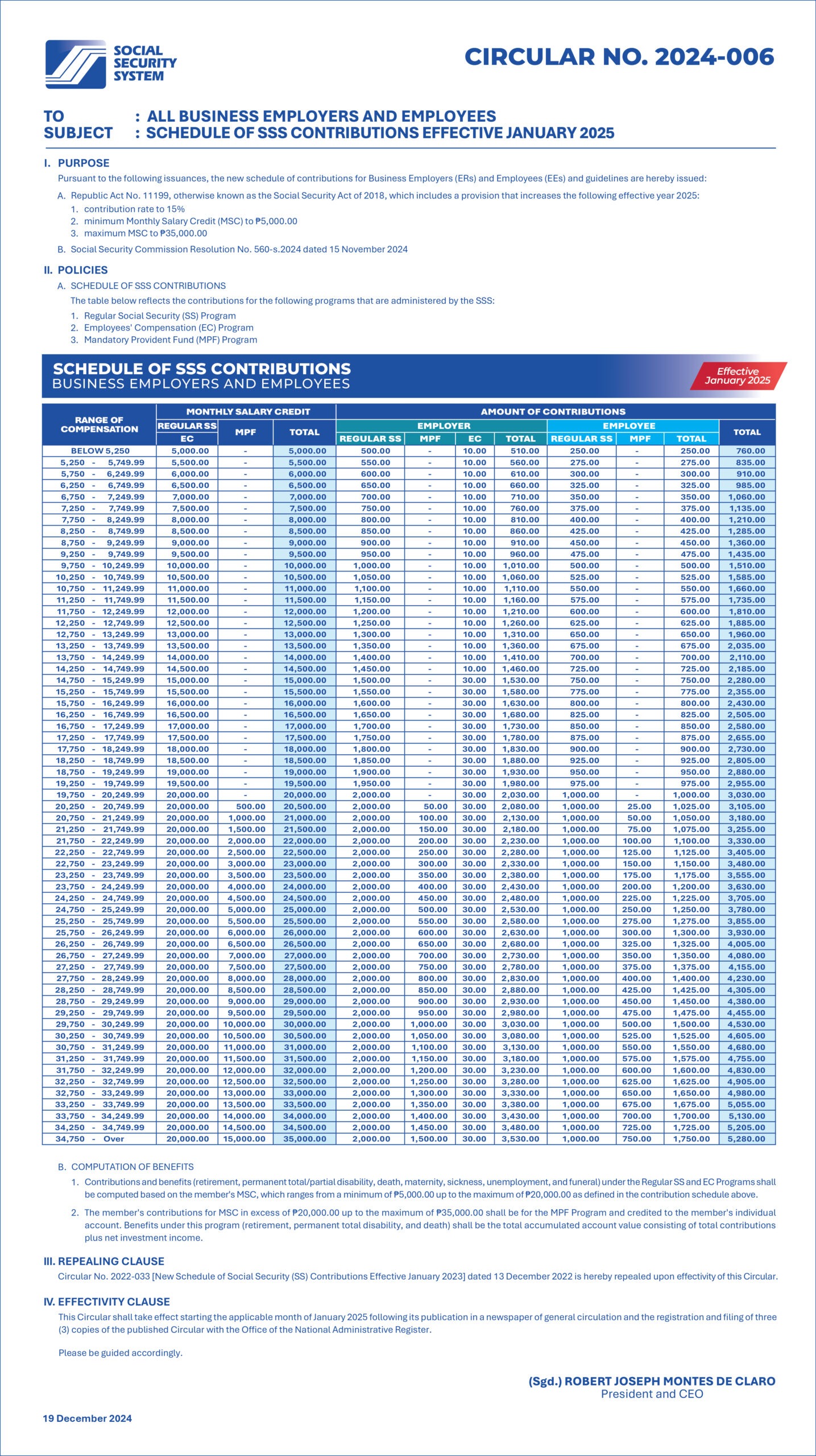

We would like to inform you that, as per SSS Circular No. 2024-006, the new schedule of Social Security contributions has been in effect since January 2025, in line with Republic Act No. 11199 (Social Security Act of 2018). The contribution rate is now 15%, with the minimum Monthly Salary Credit (MSC) set at P5,000 and the maximum at P35,000.

This schedule applies to both Employers (ER) and Employees (EE) and includes contributions for Regular Social Security (SS) Program, Employees’ Compensation (EC) Program, and Mandatory Provident Fund (MPF) Program administered by the SSS. The Social Security Commission (SSC) approved this through Resolution No. 560-s.2024, dated 15 November 2024.

To help you understand these changes, we have provided a summary of the new schedule of contributions for all SSS programs.

Check out the table below for the updated contributions for Regular SS, Employees’ Compensation (EC), and Mandatory Provident Fund (MPF) administered by SSS. Stay informed and plan accordingly!

| RANGE OF COMPENSATION |

MONTHLY SALARY CREDIT | AMOUNT OF CONTRIBUTIONS | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| REGULAR SS EC |

MPF | TOTAL | EMPLOYER | EMPLOYEE | TOTAL | ||||||

| REGULAR SS | MPF | EC | TOTAL | REGULAR SS | MPF | TOTAL | |||||

| BELOW 5,250 | 5,000.00 | – | 5,000.00 | 500.00 | – | 10.00 | 510.00 | 250.00 | – | 250.00 | 760.00 |

| 5,250 – 5,749.99 | 5,500.00 | – | 5,500.00 | 550.00 | – | 10.00 | 560.00 | 275.00 | – | 275.00 | 835.00 |

| 5,750 – 6,249.99 | 6,000.00 | – | 6,000.00 | 600.00 | – | 10.00 | 610.00 | 300.00 | – | 300.00 | 910.00 |

| 6,250 – 6,749.99 | 6,500.00 | – | 6,500.00 | 650.00 | – | 10.00 | 660.00 | 325.00 | – | 325.00 | 985.00 |

| 6,750 – 7,249.99 | 7,000.00 | – | 7,000.00 | 700.00 | – | 10.00 | 710.00 | 350.00 | – | 350.00 | 1,060.00 |

| 7,250 – 7,749.99 | 7,500.00 | – | 7,500.00 | 750.00 | – | 10.00 | 760.00 | 375.00 | – | 375.00 | 1,135.00 |

| 7,750 – 8,249.99 | 8,000.00 | – | 8,000.00 | 800.00 | – | 10.00 | 810.00 | 400.00 | – | 400.00 | 1,210.00 |

| 8,250 – 8,749.99 | 8,500.00 | – | 8,500.00 | 850.00 | – | 10.00 | 860.00 | 425.00 | – | 425.00 | 1,285.00 |

| 8,750 – 9,249.99 | 9,000.00 | – | 9,000.00 | 900.00 | – | 10.00 | 910.00 | 450.00 | – | 450.00 | 1,360.00 |

| 9,250 – 9,749.99 | 9,500.00 | – | 9,500.00 | 950.00 | – | 10.00 | 960.00 | 475.00 | – | 475.00 | 1,435.00 |

| 9,750 – 10,249.99 | 10,000.00 | – | 10,000.00 | 1,000.00 | – | 10.00 | 1,010.00 | 500.00 | – | 500.00 | 1,510.00 |

| 10,250 – 10,749.99 | 10,500.00 | – | 10,500.00 | 1,050.00 | – | 10.00 | 1,060.00 | 525.00 | – | 525.00 | 1,585.00 |

| 10,750 – 11,249.99 | 11,000.00 | – | 11,000.00 | 1,100.00 | – | 10.00 | 1,110.00 | 550.00 | – | 550.00 | 1,660.00 |

| 11,250 – 11,749.99 | 11,500.00 | – | 11,500.00 | 1,150.00 | – | 10.00 | 1,160.00 | 575.00 | – | 575.00 | 1,735.00 |

| 11,750 – 12,249.99 | 12,000.00 | – | 12,000.00 | 1,200.00 | – | 10.00 | 1,210.00 | 600.00 | – | 600.00 | 1,810.00 |

| 12,250 – 12,749.99 | 12,500.00 | – | 12,500.00 | 1,250.00 | – | 10.00 | 1,260.00 | 625.00 | – | 625.00 | 1,885.00 |

| 12,750 – 13,249.99 | 13,000.00 | – | 13,000.00 | 1,300.00 | – | 10.00 | 1,310.00 | 650.00 | – | 650.00 | 1,960.00 |

| 13,250 – 13,749.99 | 13,500.00 | – | 13,500.00 | 1,350.00 | – | 10.00 | 1,360.00 | 675.00 | – | 675.00 | 2,035.00 |

| 13,750 – 14,249.99 | 14,000.00 | – | 14,000.00 | 1,400.00 | – | 10.00 | 1,410.00 | 700.00 | – | 700.00 | 2,110.00 |

| 14,250 – 14,749.99 | 14,500.00 | – | 14,500.00 | 1,450.00 | – | 10.00 | 1,460.00 | 725.00 | – | 725.00 | 2,185.00 |

| 14,750 – 15,249.99 | 15,000.00 | – | 15,000.00 | 1,500.00 | – | 30.00 | 1,530.00 | 750.00 | – | 750.00 | 2,280.00 |

| 15,250 – 15,749.99 | 15,500.00 | – | 15,500.00 | 1,550.00 | – | 30.00 | 1,580.00 | 775.00 | – | 775.00 | 2,355.00 |

| 15,750 – 16,249.99 | 16,000.00 | – | 16,000.00 | 1,600.00 | – | 30.00 | 1,630.00 | 800.00 | – | 800.00 | 2,430.00 |

| 16,250 – 16,749.99 | 16,500.00 | – | 16,500.00 | 1,650.00 | – | 30.00 | 1,680.00 | 825.00 | – | 825.00 | 2,505.00 |

| 16,750 – 17,249.99 | 17,000.00 | – | 17,000.00 | 1,700.00 | – | 30.00 | 1,730.00 | 850.00 | – | 850.00 | 2,580.00 |

| 17,250 – 17,749.99 | 17,500.00 | – | 17,500.00 | 1,750.00 | – | 30.00 | 1,780.00 | 875.00 | – | 875.00 | 2,655.00 |

| 17,750 – 18,249.99 | 18,000.00 | – | 18,000.00 | 1,800.00 | – | 30.00 | 1,830.00 | 900.00 | – | 900.00 | 2,730.00 |

| 18,250 – 18,749.99 | 18,500.00 | – | 18,500.00 | 1,850.00 | – | 30.00 | 1,880.00 | 925.00 | – | 925.00 | 2,805.00 |

| 18,750 – 19,249.99 | 19,000.00 | – | 19,000.00 | 1,900.00 | – | 30.00 | 1,930.00 | 950.00 | – | 950.00 | 2,880.00 |

| 19,250 – 19,749.99 | 19,500.00 | – | 19,500.00 | 1,950.00 | – | 30.00 | 1,980.00 | 975.00 | – | 975.00 | 2,955.00 |

| 19,750 – 20,249.99 | 20,000.00 | – | 20,000.00 | 2,000.00 | – | 30.00 | 2,030.00 | 1,000.00 | – | 1,000.00 | 3,030.00 |

| 20,250 – 20,749.99 | 20,000.00 | 500.00 | 20,500.00 | 2,000.00 | 50.00 | 30.00 | 2,080.00 | 1,000.00 | 25.00 | 1,025.00 | 3,105.00 |

| 20,750 – 21,249.99 | 20,000.00 | 1,000.00 | 21,000.00 | 2,000.00 | 100.00 | 30.00 | 2,130.00 | 1,000.00 | 50.00 | 1,050.00 | 3,180.00 |

| 21,250 – 21,749.99 | 20,000.00 | 1,500.00 | 21,500.00 | 2,000.00 | 150.00 | 30.00 | 2,180.00 | 1,000.00 | 75.00 | 1,075.00 | 3,255.00 |

| 21,750 – 22,249.99 | 20,000.00 | 2,000.00 | 22,000.00 | 2,000.00 | 200.00 | 30.00 | 2,230.00 | 1,000.00 | 100.00 | 1,100.00 | 3,330.00 |

| 22,250 – 22,749.99 | 20,000.00 | 2,500.00 | 22,500.00 | 2,000.00 | 250.00 | 30.00 | 2,280.00 | 1,000.00 | 125.00 | 1,125.00 | 3,405.00 |

| 22,750 – 23,249.99 | 20,000.00 | 3,000.00 | 23,000.00 | 2,000.00 | 300.00 | 30.00 | 2,330.00 | 1,000.00 | 150.00 | 1,150.00 | 3,480.00 |

| 23,250 – 23,749.99 | 20,000.00 | 3,500.00 | 23,500.00 | 2,000.00 | 350.00 | 30.00 | 2,380.00 | 1,000.00 | 175.00 | 1,175.00 | 3,555.00 |

| 23,750 – 24,249.99 | 20,000.00 | 4,000.00 | 24,000.00 | 2,000.00 | 400.00 | 30.00 | 2,430.00 | 1,000.00 | 200.00 | 1,200.00 | 3,630.00 |

| 24,250 – 24,749.99 | 20,000.00 | 4,500.00 | 24,500.00 | 2,000.00 | 450.00 | 30.00 | 2,480.00 | 1,000.00 | 225.00 | 1,225.00 | 3,705.00 |

| 24,750 – 25,249.99 | 20,000.00 | 5,000.00 | 25,000.00 | 2,000.00 | 500.00 | 30.00 | 2,530.00 | 1,000.00 | 250.00 | 1,250.00 | 3,780.00 |

| 25,250 – 25,749.99 | 20,000.00 | 5,500.00 | 25,500.00 | 2,000.00 | 550.00 | 30.00 | 2,580.00 | 1,000.00 | 275.00 | 1,275.00 | 3,855.00 |

| 25,750 – 26,249.99 | 20,000.00 | 6,000.00 | 26,000.00 | 2,000.00 | 600.00 | 30.00 | 2,630.00 | 1,000.00 | 300.00 | 1,300.00 | 3,930.00 |

| 26,250 – 26,749.99 | 20,000.00 | 6,500.00 | 26,500.00 | 2,000.00 | 650.00 | 30.00 | 2,680.00 | 1,000.00 | 325.00 | 1,325.00 | 4,005.00 |

| 26,750 – 27,249.99 | 20,000.00 | 7,000.00 | 27,000.00 | 2,000.00 | 700.00 | 30.00 | 2,730.00 | 1,000.00 | 350.00 | 1,350.00 | 4,080.00 |

| 27,250 – 27,749.99 | 20,000.00 | 7,500.00 | 27,500.00 | 2,000.00 | 750.00 | 30.00 | 2,780.00 | 1,000.00 | 375.00 | 1,375.00 | 4,155.00 |

| 27,750 – 28,249.99 | 20,000.00 | 8,000.00 | 28,000.00 | 2,000.00 | 800.00 | 30.00 | 2,830.00 | 1,000.00 | 400.00 | 1,400.00 | 4,230.00 |

| 28,250 – 28,749.99 | 20,000.00 | 8,500.00 | 28,500.00 | 2,000.00 | 850.00 | 30.00 | 2,880.00 | 1,000.00 | 425.00 | 1,425.00 | 4,305.00 |

| 28,750 – 29,249.99 | 20,000.00 | 9,000.00 | 29,000.00 | 2,000.00 | 900.00 | 30.00 | 2,930.00 | 1,000.00 | 450.00 | 1,450.00 | 4,380.00 |

| 29,250 – 29,749.99 | 20,000.00 | 9,500.00 | 29,500.00 | 2,000.00 | 950.00 | 30.00 | 2,980.00 | 1,000.00 | 475.00 | 1,475.00 | 4,455.00 |

| 29,750 – 30,249.99 | 20,000.00 | 10,000.00 | 30,000.00 | 2,000.00 | 1,000.00 | 30.00 | 3,030.00 | 1,000.00 | 500.00 | 1,500.00 | 4,530.00 |

| 30,250 – 30,749.99 | 20,000.00 | 10,500.00 | 30,500.00 | 2,000.00 | 1,050.00 | 30.00 | 3,080.00 | 1,000.00 | 525.00 | 1,525.00 | 4,605.00 |

| 30,750 – 31,249.99 | 20,000.00 | 11,000.00 | 31,000.00 | 2,000.00 | 1,100.00 | 30.00 | 3,130.00 | 1,000.00 | 550.00 | 1,550.00 | 4,680.00 |

| 31,250 – 31,749.99 | 20,000.00 | 11,500.00 | 31,500.00 | 2,000.00 | 1,150.00 | 30.00 | 3,180.00 | 1,000.00 | 575.00 | 1,575.00 | 4,755.00 |

| 31,750 – 32,249.99 | 20,000.00 | 12,000.00 | 32,000.00 | 2,000.00 | 1,200.00 | 30.00 | 3,230.00 | 1,000.00 | 600.00 | 1,600.00 | 4,830.00 |

| 32,250 – 32,749.99 | 20,000.00 | 12,500.00 | 32,500.00 | 2,000.00 | 1,250.00 | 30.00 | 3,280.00 | 1,000.00 | 625.00 | 1,625.00 | 4,905.00 |

| 32,750 – 33,249.99 | 20,000.00 | 13,000.00 | 33,000.00 | 2,000.00 | 1,300.00 | 30.00 | 3,330.00 | 1,000.00 | 650.00 | 1,650.00 | 4,980.00 |

| 33,250 – 33,749.99 | 20,000.00 | 13,500.00 | 33,500.00 | 2,000.00 | 1,350.00 | 30.00 | 3,380.00 | 1,000.00 | 675.00 | 1,675.00 | 5,055.00 |

| 33,750 – 34,249.99 | 20,000.00 | 14,000.00 | 34,000.00 | 2,000.00 | 1,400.00 | 30.00 | 3,430.00 | 1,000.00 | 700.00 | 1,700.00 | 5,130.00 |

| 34,250 – 34,749.99 | 20,000.00 | 14,500.00 | 34,500.00 | 2,000.00 | 1,450.00 | 30.00 | 3,480.00 | 1,000.00 | 725.00 | 1,725.00 | 5,205.00 |

| 34,750 – Over | 20,000.00 | 15,000.00 | 35,000.00 | 2,000.00 | 1,500.00 | 30.00 | 3,530.00 | 1,000.00 | 750.00 | 1,750.00 | 5,280.00 |

Souce (click to open)

Related Posts

- SSS Contribution Table for Self Employed

- SSS Contribution Table for OFW

- SSS Contribution Table for Voluntary and Non-Working Spouses

- SSS Contribution Table for Household Employers and Kasambahays

- New SSS Contribution Table

- Making SSS Contribution Payments Easier Through Partner Channels

- How to Pay SSS Contributions in Bayad Center?

This table provides employers and employees with an easy-to-understand overview of the social security contributions required for each party. However, we will explain how employee and employer contributions are calculated, as well as special cases or exceptions that may apply.

You can find the current salary brackets and contribution rates in the table. It’s important to note that these rates may change from time to time, so it’s best to check the latest rates before calculating an employee’s contribution.

Overview of the SSS Contribution Table for Employees and Employers

The SSS Contribution Table for employers and employees is a document that outlines the various contribution rates for various types of employment, including salaried employees. It is based on the salary or wages that the employee earns from the employer.

This table is updated annually to reflect changes in wages and salaries. The table also takes into account inflation and economic conditions.

It is important to note that the table does not necessarily represent the exact contributions and benefits owed by an employer or employee. Rather, it serves as a guide to help employers and employees understand their responsibilities and plan accordingly.

Difference between Employee’s and Employer’s Contribution Tables

The SSS Contribution Table is divided into two parts: the employee’s contribution table and the employer’s contribution table. The employee contribution table outlines the minimum and maximum monthly salaries of covered employees, the minimum and maximum monthly contributions for each salary bracket, as well as the required contributions for each salary bracket.

Further, the SSS Table outlines the required contributions that must be made by both the employer and the employee. It is a legal document that must be submitted to the SSS by the employer.

Employee’s SSS Contributions

Employee contributions to the SSS are based on their monthly salary credit, which is the highest amount of earnings that is used to compute their monthly contributions.

The minimum monthly salary credit is P5,000, while the maximum is P35,000. Employees with a monthly salary credit of P5,000 or less are required to contribute P250 per month.

For those with a monthly salary credit of more than P5,000, their contributions are calculated using the formula discussed below to calculate contributions.

How to Calculate Employee Contributions?

The monthly SSS contribution of an employee depends on their salary and contributions are based on the salary bracket they fall under. Here is the formula you can use to calculate an employee’s monthly SSS contribution:

Monthly SSS Contribution = Regular SS + MPF (if applicable)

Here is an example of how to use the formula to calculate an employee’s monthly SSS contribution:

Let’s say an employee has a monthly salary of P35,000. Using the contribution table, we can determine:

Regular SS: P1,000

MPF: P750

Total Employee Contribution: P1,750

The employee’s monthly SSS contribution would be P1,750 in this example.

It’s important to note that the employer is also required to make a contribution to the employee’s SSS account, so the total monthly SSS contribution for the employee would be the sum of the employee’s contribution and the employer’s contribution.

You can find the current employer contribution rates in the SSS table.

Employer’s SSS Contribution Table

Employer contributions to the SSS are calculated using the same formula as employee contributions but with a different set of contribution rates and contribution credits.

Employers with a monthly salary credit of P5,000 or less are required to contribute P510 per month.

How to Calculate Employer’s Contributions?

For those with a monthly salary credit of more than P5,000, their contributions are calculated using the following formula:

Employer’s monthly SSS contribution = Regular SS + EC + MPF (if applicable)

Employer contributions to the SSS are calculated based on the employee’s salary and other compensation. The current contribution rate for employers includes Regular SS contributions, EC of P30, and MPF for higher salary brackets.

Employers are required by law to make these contributions on behalf of their employees, and failure to do so can result in penalties and fines.

How to File and Pay Contributions?

Employers and employees must file and pay their contributions to the SSS fund on a monthly basis.

- Employers are required to submit their contributions within 15 days after the end of the month.

- Employees must pay within 10 days after the end of the month.

Payments must be made directly to the SSS or through authorized banks or financial institutions.

My employer is not paying my SSS contributions. What should I do?

Non-remittance of SSS contributions by employers is a violation of the Social Security Law.

Employees must take prompt action by discussing any discrepancy with their HR or employer and filing a complaint at the nearest SSS branch with necessary proof of employment.

Employees must understand their rights and seek assistance from the SSS if their employer fails to remit their contributions on time. It is crucial to have payslips that reflect SSS deductions from their salary to serve as proof of any discrepancy found.

Legal action can be taken against delinquent employers who deliberately avoid paying their employees’ contributions for a long time.

The Social Security Law imposes a fine of ₱5,000 to ₱20,000 or imprisonment for more than six years to 12 years on such employers. Additionally, they must remit all unpaid contributions plus a 3% penalty for each unpaid month.

Employees who encounter such violations must file complaints with the SSS, bringing their payslip, company ID, employment contract, and income tax return as proof of employment.

The SSS Accounts Officer will guide them throughout the process of filing a complaint.

Conclusion

Understanding and using the SSS Contribution Table is an essential tool for employers and employees in the Philippines. It helps employers determine the number of contributions they must pay to the SSS fund.

Additionally, it helps employees know the amount of contributions they need to make in order to be eligible for social security and insurance benefits. Understanding and using the SSS Contribution Table is essential for employers and employees in the Philippines.

Check the SSS Contribution Calculator now to calculate the monthly contribution for employers and employees.