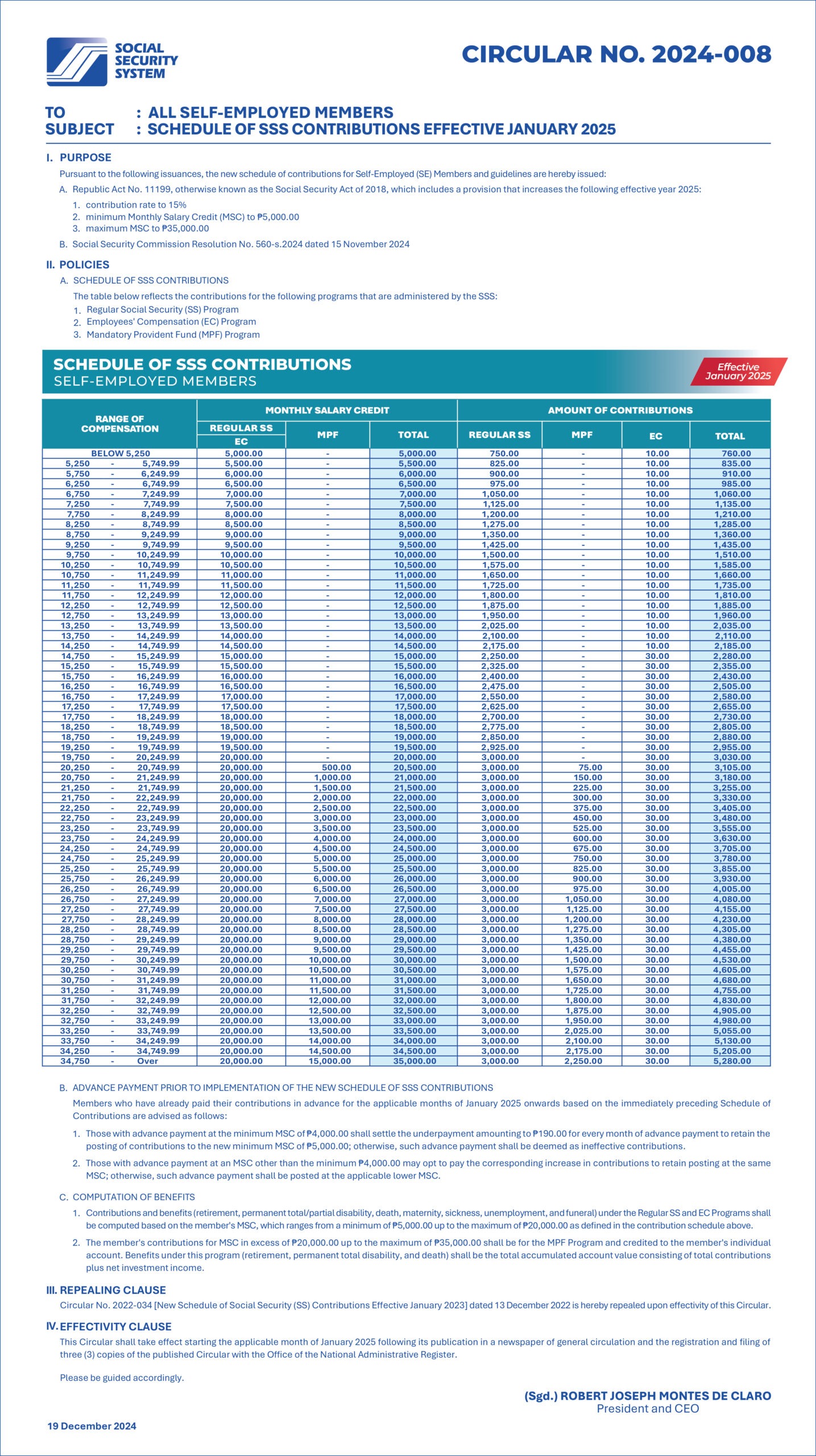

SSS Contribution Table for Self-Employed in 2025

The SSS Contribution Table for Self-Employed Individuals is a tool for self-employed individuals in the Philippines to understand their obligations to the Social Security System. Self-employed individuals are required to pay monthly contributions to the SSS based on their income to fund the SSS pension and other benefits.

Self-employed individuals in the Philippines can use this SSS Self-Employed Contribution Table 2025 to determine how much they need to contribute to the SSS based on their monthly income.

This information is crucial for understanding and meeting their obligations as members of the Social Security System.

SSS Contributions for Self-Employed Individuals Table in 2025

| Range of Compensation | Monthly Salary Credit | Amount of Contributions | |||||

|---|---|---|---|---|---|---|---|

| Regular SS/EC | WISP | Total | Regular SS | EC | WISP | Total | |

| Below ₱5,250 | ₱5,000.00 | – | ₱5,000.00 | ₱750.00 | ₱10.00 | – | ₱760.00 |

| ₱5,250 – ₱5,749.99 | ₱5,500.00 | – | ₱5,500.00 | ₱825.00 | ₱10.00 | – | ₱835.00 |

| ₱5,750 – ₱6,249.99 | ₱6,000.00 | – | ₱6,000.00 | ₱900.00 | ₱10.00 | – | ₱910.00 |

| ₱6,250 – ₱6,749.99 | ₱6,500.00 | – | ₱6,500.00 | ₱975.00 | ₱10.00 | – | ₱985.00 |

| ₱6,750 – ₱7,249.99 | ₱7,000.00 | – | ₱7,000.00 | ₱1,050.00 | ₱10.00 | – | ₱1,060.00 |

| ₱7,250 – ₱7,749.99 | ₱7,500.00 | – | ₱7,500.00 | ₱1,125.00 | ₱10.00 | – | ₱1,135.00 |

| ₱7,750 – ₱8,249.99 | ₱8,000.00 | – | ₱8,000.00 | ₱1,200.00 | ₱10.00 | – | ₱1,210.00 |

| ₱8,250 – ₱8,749.99 | ₱8,500.00 | – | ₱8,500.00 | ₱1,275.00 | ₱10.00 | – | ₱1,285.00 |

| ₱8,750 – ₱9,249.99 | ₱9,000.00 | – | ₱9,000.00 | ₱1,350.00 | ₱10.00 | – | ₱1,360.00 |

| ₱9,250 – ₱9,749.99 | ₱9,500.00 | – | ₱9,500.00 | ₱1,425.00 | ₱10.00 | – | ₱1,435.00 |

| ₱9,750 – ₱10,249.99 | ₱10,000.00 | – | ₱10,000.00 | ₱1,500.00 | ₱10.00 | – | ₱1,510.00 |

| ₱10,250 – ₱10,749.99 | ₱10,500.00 | – | ₱10,500.00 | ₱1,575.00 | ₱10.00 | – | ₱1,585.00 |

| ₱10,750 – ₱11,249.99 | ₱11,000.00 | – | ₱11,000.00 | ₱1,650.00 | ₱10.00 | – | ₱1,660.00 |

| ₱11,250 – ₱11,749.99 | ₱11,500.00 | – | ₱11,500.00 | ₱1,725.00 | ₱10.00 | – | ₱1,735.00 |

| ₱11,750 – ₱12,249.99 | ₱12,000.00 | – | ₱12,000.00 | ₱1,800.00 | ₱10.00 | – | ₱1,810.00 |

| ₱12,250 – ₱12,749.99 | ₱12,500.00 | – | ₱12,500.00 | ₱1,875.00 | ₱10.00 | – | ₱1,885.00 |

| ₱12,750 – ₱13,249.99 | ₱13,000.00 | – | ₱13,000.00 | ₱1,950.00 | ₱10.00 | – | ₱1,960.00 |

| ₱13,250 – ₱13,749.99 | ₱13,500.00 | – | ₱13,500.00 | ₱2,025.00 | ₱10.00 | – | ₱2,035.00 |

| ₱13,750 – ₱14,249.99 | ₱14,000.00 | – | ₱14,000.00 | ₱2,100.00 | ₱10.00 | – | ₱2,110.00 |

| ₱14,250 – ₱14,749.99 | ₱14,500.00 | – | ₱14,500.00 | ₱2,175.00 | ₱10.00 | – | ₱2,185.00 |

| ₱14,750 – ₱15,249.99 | ₱15,000.00 | – | ₱15,000.00 | ₱2,250.00 | ₱10.00 | – | ₱2,260.00 |

| ₱15,250 – ₱15,749.99 | ₱15,500.00 | – | ₱15,500.00 | ₱2,325.00 | ₱30.00 | – | ₱2,355.00 |

| ₱15,750 – ₱16,249.99 | ₱16,000.00 | – | ₱16,000.00 | ₱2,400.00 | ₱30.00 | – | ₱2,430.00 |

| ₱16,250 – ₱16,749.99 | ₱16,500.00 | – | ₱16,500.00 | ₱2,475.00 | ₱30.00 | – | ₱2,505.00 |

| ₱16,750 – ₱17,249.99 | ₱17,000.00 | – | ₱17,000.00 | ₱2,550.00 | ₱30.00 | – | ₱2,580.00 |

| ₱17,250 – ₱17,749.99 | ₱17,500.00 | – | ₱17,500.00 | ₱2,625.00 | ₱30.00 | – | ₱2,655.00 |

| ₱17,750 – ₱18,249.99 | ₱18,000.00 | – | ₱18,000.00 | ₱2,700.00 | ₱30.00 | – | ₱2,730.00 |

| ₱18,250 – ₱18,749.99 | ₱18,500.00 | – | ₱18,500.00 | ₱2,775.00 | ₱30.00 | – | ₱2,805.00 |

| ₱18,750 – ₱19,249.99 | ₱19,000.00 | – | ₱19,000.00 | ₱2,850.00 | ₱30.00 | – | ₱2,880.00 |

| ₱19,250 – ₱19,749.99 | ₱19,500.00 | – | ₱19,500.00 | ₱2,925.00 | ₱30.00 | – | ₱2,955.00 |

| ₱19,750 – ₱20,249.99 | ₱20,000.00 | – | ₱20,000.00 | ₱3,000.00 | ₱30.00 | – | ₱3,030.00 |

| ₱20,250 – ₱20,749.99 | ₱20,000.00 | ₱500.00 | ₱20,500.00 | ₱3,000.00 | ₱30.00 | ₱75.00 | ₱3,105.00 |

| ₱20,750 – ₱21,249.99 | ₱20,000.00 | ₱1,000.00 | ₱21,000.00 | ₱3,000.00 | ₱30.00 | ₱150.00 | ₱3,180.00 |

| ₱21,250 – ₱21,749.99 | ₱20,000.00 | ₱1,500.00 | ₱21,500.00 | ₱3,000.00 | ₱30.00 | ₱225.00 | ₱3,255.00 |

| ₱21,750 – ₱22,249.99 | ₱20,000.00 | ₱2,000.00 | ₱22,000.00 | ₱3,000.00 | ₱30.00 | ₱300.00 | ₱3,330.00 |

| ₱22,250 – ₱22,749.99 | ₱20,000.00 | ₱2,500.00 | ₱22,500.00 | ₱3,000.00 | ₱30.00 | ₱375.00 | ₱3,405.00 |

| ₱22,750 – ₱23,249.99 | ₱20,000.00 | ₱3,000.00 | ₱23,000.00 | ₱3,000.00 | ₱30.00 | ₱450.00 | ₱3,480.00 |

| ₱23,250 – ₱23,749.99 | ₱20,000.00 | ₱3,500.00 | ₱23,500.00 | ₱3,000.00 | ₱30.00 | ₱525.00 | ₱3,555.00 |

| ₱23,750 – ₱24,249.99 | ₱20,000.00 | ₱4,000.00 | ₱24,000.00 | ₱3,000.00 | ₱30.00 | ₱600.00 | ₱3,630.00 |

| ₱24,250 – ₱24,749.99 | ₱20,000.00 | ₱4,500.00 | ₱24,500.00 | ₱3,000.00 | ₱30.00 | ₱675.00 | ₱3,705.00 |

| ₱24,750 – ₱25,249.99 | ₱20,000.00 | ₱5,000.00 | ₱25,000.00 | ₱3,000.00 | ₱30.00 | ₱750.00 | ₱3,780.00 |

| ₱25,250 – ₱25,749.99 | ₱20,000.00 | ₱5,500.00 | ₱25,500.00 | ₱3,000.00 | ₱30.00 | ₱825.00 | ₱3,855.00 |

| ₱25,750 – ₱26,249.99 | ₱20,000.00 | ₱6,000.00 | ₱26,000.00 | ₱3,000.00 | ₱30.00 | ₱900.00 | ₱3,930.00 |

| ₱26,250 – ₱26,749.99 | ₱20,000.00 | ₱6,500.00 | ₱26,500.00 | ₱3,000.00 | ₱30.00 | ₱975.00 | ₱4,005.00 |

| ₱26,750 – ₱27,249.99 | ₱20,000.00 | ₱7,000.00 | ₱27,000.00 | ₱3,000.00 | ₱30.00 | ₱1,050.00 | ₱4,080.00 |

| ₱27,250 – ₱27,749.99 | ₱20,000.00 | ₱7,500.00 | ₱27,500.00 | ₱3,000.00 | ₱30.00 | ₱1,125.00 | ₱4,155.00 |

| ₱27,750 – ₱28,249.99 | ₱20,000.00 | ₱8,000.00 | ₱28,000.00 | ₱3,000.00 | ₱30.00 | ₱1,200.00 | ₱4,230.00 |

| ₱28,250 – ₱28,749.99 | ₱20,000.00 | ₱8,500.00 | ₱28,500.00 | ₱3,000.00 | ₱30.00 | ₱1,275.00 | ₱4,305.00 |

| ₱28,750 – ₱29,249.99 | ₱20,000.00 | ₱9,000.00 | ₱29,000.00 | ₱3,000.00 | ₱30.00 | ₱1,350.00 | ₱4,380.00 |

| ₱29,250 – ₱29,749.99 | ₱20,000.00 | ₱9,500.00 | ₱29,500.00 | ₱3,000.00 | ₱30.00 | ₱1,425.00 | ₱4,455.00 |

| ₱29,750 and up | ₱20,000.00 | ₱10,000.00 | ₱30,000.00 | ₱3,000.00 | ₱30.00 | ₱1,500.00 | ₱4,530.00 |

Source: (click to show)

Related Posts

- SSS Contribution Table 2025 – Detailed Information

- SSS Contribution Table for OFW

- SSS Contribution Table for Employees and Employers

- SSS Contribution Table for Voluntary and Non-Working Spouses

- SSS Contribution Table for Household Employers and Kasambahays

- Making SSS Contribution Payments Easier Through Partner Channels

- How to Pay SSS Contributions in Bayad Center?

SSS Coverage for Self-Employed Individuals

To be eligible for SSS coverage as a self-employed individual, you must be engaged in a trade, business, or profession. Additionally, you must have an annual net income of at least P16,000.

To register for SSS coverage as a self-employed individual, you must complete the following steps:

- Visit the nearest SSS branch to obtain the necessary forms and documents.

- Fill out the application form and provide proof of your trade, business, or profession, such as a business permit or certificate of registration.

- Submit the completed form and supporting documents to the SSS branch, along with your initial contribution payment.

- Once your application has been processed, you will receive your SSS number, which you will need to verify and use when making future contributions and accessing benefits.

It’s important to note that SSS contributions are mandatory for all self-employed individuals who meet the eligibility criteria, and failure to make contributions can result in penalties.

SSS Contribution Rates for Self-Employed Individuals in 2025

In the Philippines, self-employed individuals are required to contribute to the Social Security System (SSS) if they are engaged in the following activities:

- Trade, business, or profession, whether single proprietorship or partnership, with or without employees.

- Services that are performed by professionals, such as doctors, lawyers, engineers, and accountants.

- Services performed by actors, directors, scriptwriters, and news correspondents.

- Services performed by musicians, singers, and dancers.

The contribution rate for self-employed individuals is 15% of the monthly salary credit in 2025, which is the amount used to compute the benefits and contributions of an SSS member.

The monthly salary credit is based on the gross income of the self-employed individual. For regular Social Security (SS) and Employee’s Compensation (EC), the maximum monthly salary credit is ₱20,000. Additionally, for those earning above ₱20,249.99, there is a Worker’s Investment and Savings Program (WISP) component that can extend the coverage up to ₱30,000.

Self-employed individuals are required to report their gross income to the SSS on a quarterly basis, and they must pay their contributions on a monthly basis. Failure to pay the required contributions can result in penalties and interest charges.

How To compute SSS contributions for self-employed?

To compute the SSS monthly contributions for self-employed individuals, you will need to follow these steps:

Determine The Monthly Salary Credit of Self-employed Individual

This is the amount used to compute your benefits and contributions. It is based on your gross income. For regular SS/EC, it is limited to the maximum of ₱20,000 per month. If your income exceeds ₱20,249.99, you will also need to contribute to WISP, which can bring your total monthly salary credit up to ₱30,000.

Calculate the Amount of Monthly Contribution

The contribution rate for self-employed individuals is 15% of the monthly salary credit plus Employee’s compensation (EC). To calculate your contribution, multiply your monthly salary credit by 15% (0.15) plus EC.

For example, if your monthly salary credit is PHP 15,000, your contribution will be PHP 2,280 (15,000 x 0.15 + 30).

Check the WISP Amount For Self-Employed Members

Self-employed individuals are also required to pay the Worker’s Investment and Savings Program (WISP) amount if the range of compensation is over PHP 20,249.99.

For example, if your monthly salary credit is PHP 25,000, your WISP will be PHP 5000. In this case, your monthly contribution would be PHP 3,780 (₱3,000 + ₱30 + ₱750).

For the latest payment schedule for the other types of contributions, must check the new SSS contribution table.

Benefits of Self-Employed SSS Contributions

Self-employed individuals who make SSS contributions are eligible for a range of benefits through the Social Security System (SSS) in the Philippines. These benefits include

1. Sickness benefit

This provides a daily cash allowance for self-employed individuals who are unable to work due to illness or injury. The allowance is paid for a maximum of 120 days per year. Check the list of sicknesses covered by SSS.

2. Maternity benefit

SSS maternity benefit provides self-employed individuals with a daily cash allowance for the duration of their maternity leave, up to a maximum of 60 days.

3. Disability benefit

This provides a cash allowance to self-employed individuals who become permanently disabled and are unable to work. The amount of the allowance depends on the degree of disability.

4. Retirement benefit

This provides a monthly pension to self-employed individuals who have reached the age of 60 and have made at least 120 monthly contributions to the SSS.

The amount of the pension depends on the individual’s contributions and length of service.

5. Death benefit

This provides a lump sum payment to the beneficiaries of a deceased self-employed individual who was an SSS member.

The amount of the benefit depends on the individual’s contributions and length of service.

6. Funeral and burial assistance

The SSS provides financial assistance to help cover the cost of funeral and burial expenses for deceased members.

The amount of assistance depends on the individual’s contributions and length of service.

7. Loans and advances

The SSS offers various types of loans and advances to members, including housing loans, salary loans, calamity loans, and educational assistance loans.

These loans are available at favorable rates and can be used for a variety of purposes.

8. Medical and dental services

The SSS operates its network of medical and dental facilities, where members can receive treatment at reduced rates.

This can help self-employed individuals save money on medical expenses.

9. Other services

The SSS also offers a range of other services to members, including legal assistance, career guidance, and counseling services.

Overall, the benefits of SSS contributions for self-employed individuals can be significant, providing them with access to a range of financial, medical, and other services.

That can help protect their health and financial security.