SSS E1 Form – Comprehensive Guide for Employees [Download Now ]

If you’re an employee in the Philippines, you may have heard of the SSS E1 Form. This form is an important document that you need to have to access the benefits provided by the Social Security System (SSS). This form is a requirement for every member of the SSS. It serves as your identification as a member and is necessary for filing claims and applying for loans.

In this article, we will provide you with a comprehensive guide to the SSS E1 Form. We will explain what it is, why it is important, and how to get it.

What is the SSS E1 form?

The SSS E1 form is a document that is used to register an individual as a member of the Social Security System (SSS) and provide them with their unique SSS number.

This form is typically used by employees who are working for a private company, as well as self-employed individuals and voluntary members.

The SSS E1 form serves as the initial registration document for individuals who wish to avail of the benefits provided by the SSS.

Purpose of the SSS E1 form

The primary purpose of the SSS E1 form is to register an individual as a member of the SSS. The SSS is a government agency that provides social security benefits to its members, including retirement, disability, maternity, and death benefits, among others.

By registering with the SSS, an individual becomes eligible to receive these benefits, provided that they have met the necessary requirements.

Who needs to fill out the SSS E1 form?

All employees working for a private company, including household employees, are required to register with the SSS and fill out the SSS E1 form.

Self-employed individuals and voluntary members are also required to register with the SSS and fill out the same form.

How to Get SSS E1 Form Online?

Step 1: Visit the SSS Website and Access the Forms Section

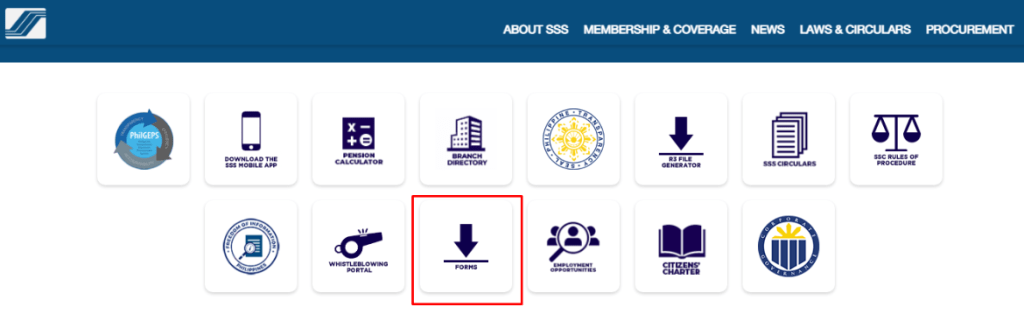

Begin by navigating to the official SSS website at www.sss.gov.ph. Once there, scroll down to the bottom of the page until you spot the “Forms” link.

Click on the “Forms” link to access a range of downloadable SSS forms. It’s important to note that obtaining an E1 form online does not require any registration process.

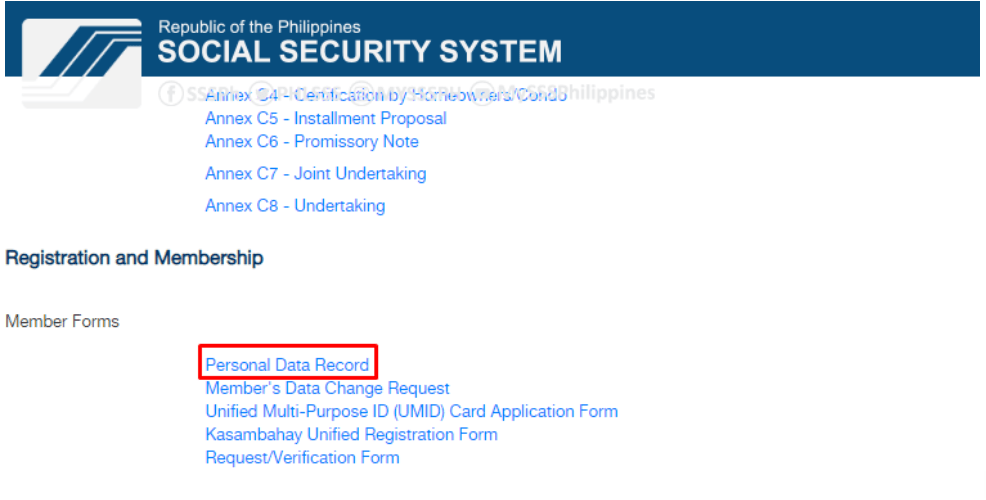

Step 2: Choose the Personal Data Record E1 Form from the List

On the subsequent page, you will find a collection of SSS forms available for download. Look for the “Member Forms” column and proceed to select the “Personal Data Record” link, which will lead you to the E1 form.

Download and Print the SSS E1 Form

You have two options when it comes to acquiring the form: downloading it and saving a PDF copy on your computer, or directly printing the E1 form. To print it directly, locate the printer icon positioned at the upper right-hand corner of your browser.

Now click on it and choose the desired printer, specify the number of copies, select the orientation (portrait or landscape), and indicate the page number.

Once you have set the necessary parameters, proceed to print your E1 form. For printing, make sure to use long bond paper measuring 8.5 x 14 inches. By following these instructions, you can easily obtain an online copy of the SSS E1 form without encountering any complications.

Instructions to fill out the SSS E1 Form

- Complete the following form and submit it to the nearest SSS branch office along with the necessary documents.

- Provide the requested information in the appropriate sections based on your specific situation:

- Parts I-A, B, and D: If you are applying for an SS number as a pre-employment requirement.

- Parts I-A, B, C, and D: If you are applying for membership as a Self-Employed individual, Overseas Filipino Worker (OFW), or Non-Working Spouse.

- If you require additional space for providing information about your dependents or beneficiaries, please utilize the “Additional Sheet for Dependent(s)/Beneficiary/(ies)”.

- Whenever a particular data field is not applicable, kindly indicate “N/A” or “Not Applicable”.

- In case you are downloading this form from the internet, please ensure to fill out two (2) copies.

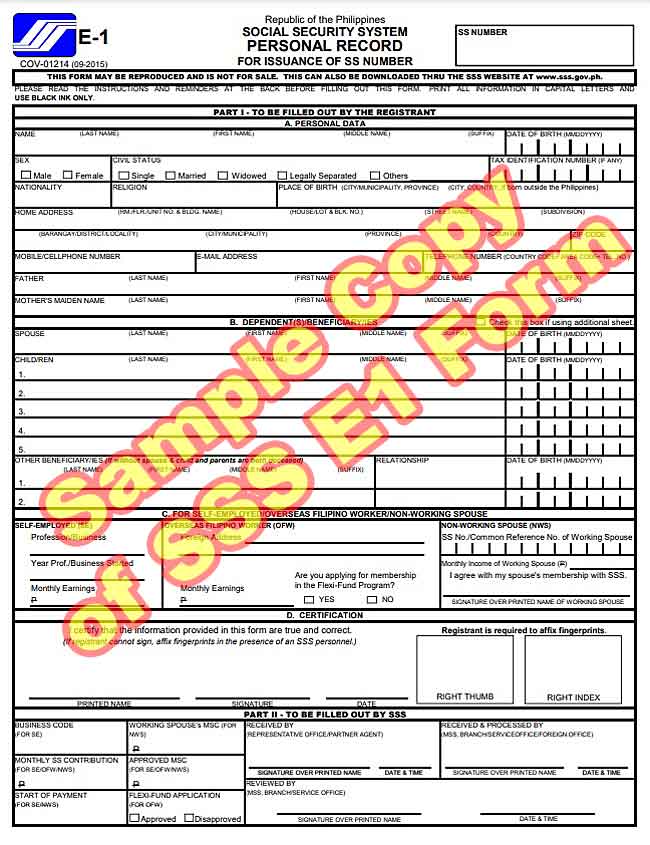

SSS E1 Form Sample

If you wish to have a visual reference, you can find a sample copy of the SSS E1 form below. Simply follow the steps outlined above to access it. Remember, the SSS E1 form is provided free of charge and should not be purchased.

If you have lost your previous copy, you can print as many new copies as needed.

Important Reminders

- Individuals who are over sixty (60) years old and are not surviving spouse pensioners or guardians of pensioners are ineligible to apply for an SS number as new registrants.

- Your SS number is unique and meant to be used throughout your lifetime. It is essential to maintain only one SS number and not acquire multiple numbers.

- The required documents must be submitted in their original form or as certified true copies issued by the City or Municipal Civil Registrar or the Philippine Statistics Authority/National Statistics Office. These documents include:

- 3.1 Birth Certificate

- 3.2 Marriage Contract or Marriage Certificate

- 3.3 Death Certificate (if applicable)

- Identification (ID) cards and documents issued by foreign governments, along with their English translations, are acceptable for submission and verification purposes.

What are the common mistakes to avoid when filling out the SSS E1 Form?

Filling out the SSS E1 Form correctly is crucial to avoid delays or errors in your registration. Here are some common mistakes to avoid:

- Providing incorrect personal information

- Leaving blank fields or sections

- Providing incomplete or incorrect employment history

- Forgetting to add your beneficiaries’ information

- Not signing the form or submitting it without a valid ID

How long does it take to process the SSS E1 Form?

Receiving your SSS E1 form can be a time-consuming process, typically taking several months to reach your email. The SSS handles numerous requests daily, necessitating manual record retrieval, digital scanning, and email delivery, which contribute to the extended timeline.

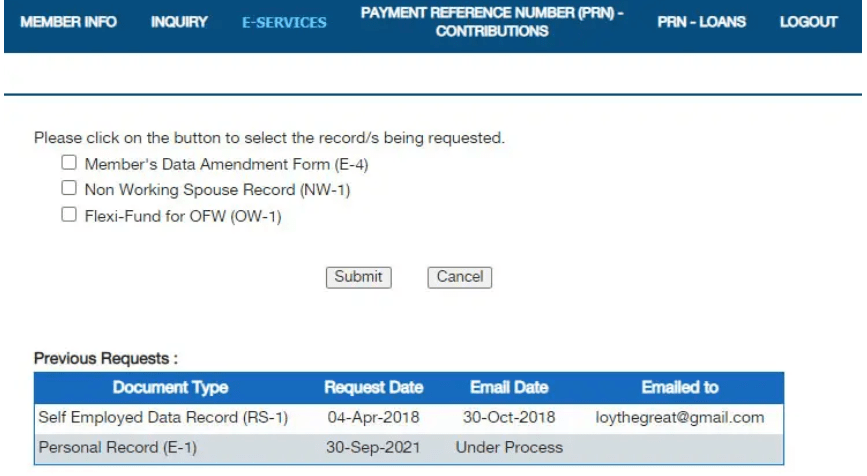

For instance, a previous request for a self-employed data record made in April was only received in October, indicating a wait of over six months. Considering the current situation, it’s possible that the processing time for your SSS E1 forms maybe even longer.

To stay informed, regularly check your SSS online account for updates on your request status. If the status shows that the form has been emailed but hasn’t arrived in your inbox, remember to check your Spam folder. Sometimes, there may be a slight delay in email delivery, so be patient.

In the event you haven’t received the email within 15 days after it was sent, consider contacting the SSS to follow up on your request. It’s crucial to keep track of your SSS E1 form, as it can only be requested once.

Make sure to download and store the document securely on your computer. It’s also a good practice to print multiple copies and keep them in a safe place.

Avoid deleting the email containing your SSS E1 form. If you accidentally delete it, you can usually recover it from the Trash folder within a certain time frame, typically up to 30 days. Preserving the email ensures continued access to the form attachment.

By exercising patience, staying proactive, and taking necessary precautions, you can navigate the process smoothly and have your SSS E1 form readily available when needed.

Check the Status SSS E1 Form Application Online

To check the progress of your request, follow these steps:

- Start by clicking on the “E-SERVICES” tab.

- From the dropdown menu, select “Request Records.”

- On the Request Records page, you will find a list of your previous requests. It includes the request date and email date for each request.

- Look for the specific request you want to check. If it’s still being processed, the status will be displayed as “Under Process” under the “Email Date” column.

SSS E1 Form FAQs

Do I need to submit an SSS E1 Form every year?

No, you only need to submit the form once. However, you should update your personal information and SSS account regularly to ensure that your records are accurate and up-to-date.

What do I need to bring when I apply for an SSS E1 Form?

You need to bring a valid ID, such as your passport, driver’s license, or any government-issued ID. You may also bring a copy of your birth certificate or marriage certificate if needed.

What if the SSS E1 form is lost?

You can request a new one by visiting the nearest SSS branch. You will need to present a valid ID and pay a fee for the replacement.

If you are residing outside the Philippines, must check the list of SSS Branches Overseas (OFWs).

Can I authorize someone else to apply for an SSS E1 Form on my behalf?

Yes, you can authorize someone else to apply for the form for you. They will need to present a letter of authorization from you and a valid ID.

How long does it take to get an SSS number after submitting the E1 Form?

It usually takes several months to receive your SSS number after submitting your E1 Form.

However, you can already start monitoring your contributions through your SSS online account while waiting for your number.

Final Thoughts

The SSS E1 Form is a vital document for every member of the Social Security System in the Philippines. It serves as proof of membership and is necessary for applying for loans and claiming benefits.

Getting an SSS E1 Form is easy and can be done by visiting the nearest SSS branch. Always make sure to keep your personal information and SSS account up-to-date to avoid any inconvenience in the future.

We hope that this comprehensive guide to the SSS E1 Form has been helpful to you. If you have any other questions or concerns about the SSS E1 application or the Social Security System in general, do not hesitate to ask your query.

Please let me access my sss online transaction my account is locked .

Your SSS account may be blocked for a number of reasons:

1. Incorrect login credentials

2. Unauthorized access attempts

3. Violation of SSS terms and conditions

4. Suspicious account activity

You can unblock it yourself, we have written and a few methods how to do it here.

How to verify my sss number?

Hello, we have a post “How to Verify Your SSS Number Online” with step by step instuctions.

I want to get my sss number

If you are not yet a member of SSS, you can register at https://www.sss.gov.ph/. If you have forgotten or lost your SSS number, please read the information here.

I lost my E1 number years ago. What can I do to get my E1 number?

You can request a new one by visiting the nearest SSS branch. You will need to present a valid ID and pay a fee for the replacement.

If you are residing outside the Philippines, must check the list of SSS Branches Overseas (OFWs).